KEY TAKEAWAYS

- Corporates expect global inflation to continue rising over the next twelve months, with around 12% of respondents expecting inflation over 4%.

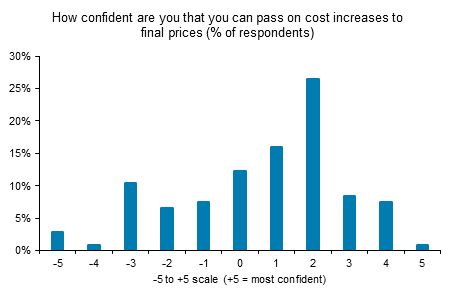

- A larger proportion of corporates expressed confidence in their ability to pass on cost increases, compared with those who found their pricing power still constrained.

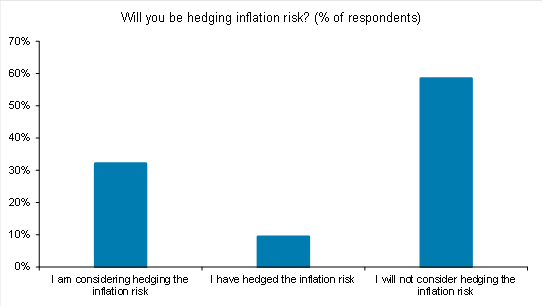

- Over 40% of respondents signalled that they have either hedged or are considering hedging against higher inflation.

As economies reopen almost 18 months after the outbreak of COVID-19, the cost of goods, materials and labour is surging. The trend was widely expected. The pandemic removed structural barriers to inflation, disrupted vital supply chains and triggered an unprecedented monetary and fiscal policy response. Whilst markets debate whether these inflationary forces will be transitory or more sustained, we turned to business leaders for their views.

The BNP Paribas 2021 Global Corporate Inflation Survey, conducted between end-July and early August, provides a valuable snapshot into how some of the world’s largest companies view the current inflationary shock, including its likely duration as well as the impact on pricing power.

I cannot recall a time when inflation has been such a high risk factor amongst CFOs and corporate treasurers.

Fabrice Famery, Global Head of Corporate Sales, BNP Paribas

According to the survey, most business leaders expect inflation to continue rising.

When asked about the prospects for global inflation over the next 12 months compared to the average rate for the previous year, almost 70% of respondents expected inflation to be higher and 12% saw inflation rising above 4%. North and South American companies recorded the highest proportion of respondents citing inflation expectations of over 5%.

The results confirm a trend BNP Paribas has witnessed in its financing and markets businesses. “I cannot recall a time when inflation has been such a high risk factor amongst CFOs and corporate treasurers”, said Fabrice Famery, Global Head of Corporate Sales at BNP Paribas.

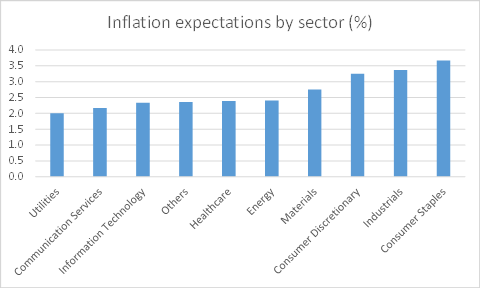

Companies in the consumer and industrial sectors expect the sharpest rises in inflation. On average, respondents in the consumer discretionary, consumer staples and industrial sectors saw inflation printing above 3% in the next 12 months – almost double the inflation rate for the previous 12 months. Part of this may reflect the fact that those three sectors currently face significant cost pressures as a result of sharp increases in raw materials prices. In the case of consumer staples, this has come at the expense of margins.

Important for the future inflation outlook is the degree to which firms feel as if they can pass on cost pressures. The majority of respondents were confident they could pass on cost increases. That said, only a few firms were very confident, whilst a still-substantial number were more hesitant – suggesting that the recovery may still have some way to go before pricing power is strengthened.

The uncertain inflation outlook is driving some companies to look for other ways of protecting their cost base against price rises. One in ten respondents stated they had already hedged some of their exposure to inflation whilst a third indicated that they are considering hedging inflation risk.

Protecting your cost base against future inflation is an effective way to sustain earnings growth and maintain competitiveness in the current environment.

Ashley Parker, Co-Head of Corporate Interest Rate and FX Sales, EMEA, BNP Paribas

“The disruption caused by the pandemic forced businesses to adapt their approach to managing financial risks quickly”, said Ashley Parker, Co-Head of Corporate Interest Rate and FX Sales, EMEA. “Protecting your cost base against future inflation is an effective way to sustain earnings growth and maintain competitiveness in the current environment.”

Although many of the drivers of the rise in inflation are transitory in their nature, this does not mean short-lived, and the greater and longer the pick-up in price pressures, the larger the risk this feeds into expectations and becomes a more sustained rise.

Paul Hollingsworth, Chief European Economist, BNP Paribas

The increased hedging activity amongst large corporates may also reflect the increasing risk of a more enduring shock.

Concerns about this risk are unlikely to dissipate in the near term, with BNP Paribas economists from our research team Markets 360 expecting the current inflation shock to prove more enduring than central banks are currently suggesting. “Although many of the drivers of the rise in inflation are transitory in their nature, this does not mean short-lived, and the greater and longer the pick-up in price pressures, the larger the risk this feeds into expectations and becomes a more sustained rise” said Paul Hollingsworth, Chief European Economist.