GM Corporate Weekly

MARKETING COMMUNICATION | For Professional clients only | 25 Jan 2025

Fabrice Famery

Head of Global Markets Corporate Sales

Read in other languages:

MARKET MOVERS

What’s going on

This week’s price action was the result of Trump’s inauguration speech, the unveiling of executive orders, and his remarks at the Davos gathering. Trump stopped short of day-one tariffs, instead directing his administration to reassess the US’s trade relationships with its partners. Although he reaffirmed the February 1 deadline for potential tariff actions against Canada and Mexico, he did not provide further details. We maintain our forecast for 10% tariff on China in Q1 and broader tariffs later this year. During his speech at Davos, Trump urged OPEC+ to increase oil production in order to drive down prices. Furthermore, he suggested that global central banks should consider lowering interest rates once oil prices decrease.

Elsewhere The Bank of Japan has raised interest rates by 25bp to 0.5% and revised inflation forecasts higher. Meanwhile Japan’s headline CPI exceeded expectations printing at 3.6% (vs. 3.4% consensus).

Markets were risk-on with S&P 500 making new all-time-high. USD weakened vs. EUR and RMB. This week, we focus on the long-term inflation expectations in the US, we share our view of lower oil prices in Q2 and provide a snapshot of our FX outlook.

US: Assessing risks to long-term inflation expectations

The recent University of Michigan survey has shown a rise in 5-10 year inflation expectations (from 3.0% to 3.3%), sparking concerns about the stability of long-term inflation expectations (LTIE). While current inflation expectations are close to the FOMC’s 2% target, they are considered unstable and vulnerable to further upward shocks. This vulnerability is a key difference between the current economic dynamics and those from just before the pandemic. The survey’s current level is not far from the top of what could be considered consistent with the FOMC’s 2% inflation mandate, and a significant further advance could give rise to concerns about the longer-term entrenchment of inflation. In light of this, the FOMC is likely to monitor inflation expectations data closely over time to judge how much caution is needed. While keeping policy on hold is expected to address risks to LTIE, the risk remains that LTIE could move higher if the new administration’s policies produce significant inflation, making rate hikes easier to envisage. For more, US: Assessing risks to long-term inflation expectations.

Crude oil markets: settling down in Q2

Crude oil markets have started 2025 on a bullish note, driven by a combination of factors including stronger-than-expected refinery margins and runs in the US, as well as the Biden administration’s imposition of tariffs on Russian crude. However, we expect the market to settle down in Q2 as the impact of these factors wears off and refinery maintenance ramps up. In the near term, we anticipate crude prices to stabilize and retrace as the cold snap in the US dissipates and refinery maintenance picks up. Demand is expected to reduce by around 2mbd in February, which should help to ease the bullish pressure on prices. We expect Brent to settle around the mid-70s/bbl through February. Looking ahead to the medium term, we see limited risk of overtightening in the market, despite the potential for additional sanctions on Iranian exports and the impact of the Trump administration’s tariffs on Russian crude. OPEC+ spare capacity and the Trump administration’s sensitivity to expensive crude should help to prevent prices from rising too high. For more, Crude lacks direction; we expect the market to settle down in Q2.

FX outlook snapshot

EURUSD: Our FX view remains bearish on EURUSD, driven by the widening US-EUR rate differentials and markets pricing in Trump’s tariff policies. We forecast EURUSD to be at parity by end-2025.

USDJPY: We expect USDJPY at 156 by end-2025, with the JPY outperforming other low-yielding currencies. Our FX view is supported by the Bank of Japan’s policy rate converging with that of the ECB and the PBoC.

GBPUSD: We have revised down our GBPUSD forecast to 1.20 in Q2, followed by a period of stabilization, with a year-end target of 1.20. Our FX view is driven by adverse fiscal dynamics and growth risks putting pressure on the Bank of England.

USDCHF: We think the CHF could grind lower, forecasting USDCHF to rise to 0.92 in Q1 2025. Our FX view is driven by the Swiss National Bank’s reluctance to tolerate a strong CHF, especially with imported inflation still negative.

USDCAD: We expect the pair to be driven by trade tensions between the US and Canada, with a forecast of 1.45 by the end of 2025. Risks for the pair remain skewed to the upside.

USDRMB: We maintain our view that USDCNY could rise to 7.45 this year under our current tariff assumptions and “appropriately loose” monetary policy environment. Our FX view is driven by the People’s Bank of China’s efforts to stabilize the currency and the potential for a weaker RMB versus both the USD and RMB’s trade-weighted currency basket.

USDINR: The INR has been under pressure due to US rate-cut expectations repriced, portfolio outflows and higher oil prices. We revise our projections for USDINR higher, now expecting the pair to rise to 88 by end-2025. Our FX view is driven by markets having not yet fully priced in US tariffs.

USDBRL: We expect the BRL to continue to underperform its peers due to ongoing concerns about Brazil’s fiscal situation, forecasting USDBRL to rise to 6.70 by year-end. Our FX view is driven by the lack of a meaningful fiscal consolidation plan from the government.

USDMXN: We have a cautious stance on the MXN, forecasting USDMXN to rise to 22.30 by the end of 2025. Our FX view is driven by US tariffs risks, and potential changes to the USMCA treaty.

For more, Corporate FX and Markets Monthly – January.

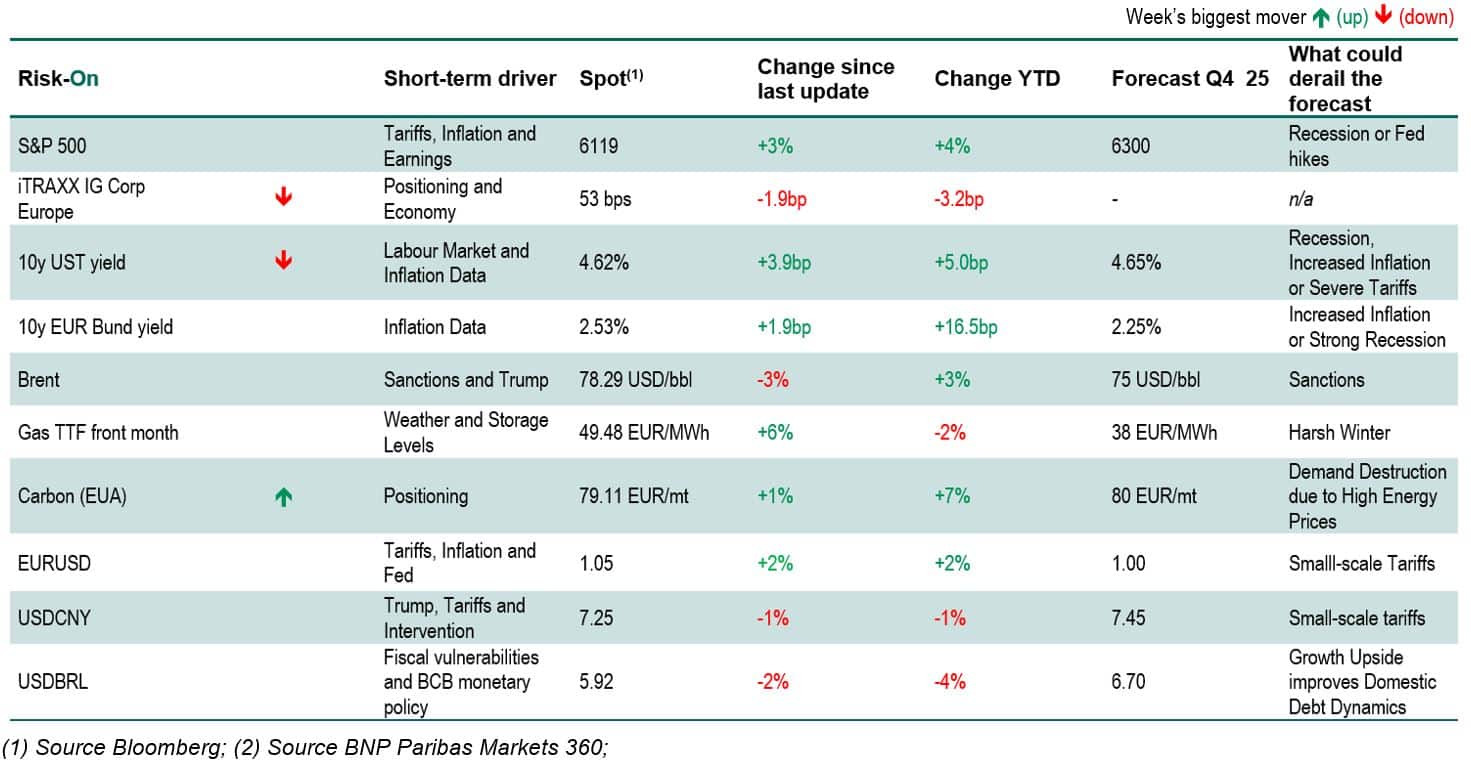

Price action since last week: Higher equities, lower USD

The S&P 500 is up 3% w/w at 6119. The 10-year US Treasury yield gained 6.2bp to 4.64%. European investment grade corporate credit spreads tightened to 53bp. The USD is 2% lower vs. EUR and 3% vs. BRL and 1% lower vs. RMB. Brent front-month is down 3% to 78.70USD/bbl. European gas gained 3% to 48.37 EUR/MWh. Carbon (EUA) is unchanged at 78.65 EUR/mt.

WHAT’S HOT WITH CORPORATE RISK MANAGEMENT

FX: With the market discounting tariff threats from President Trump, we saw corporates take advantage of the USD’s retracement to layer in fresh hedges. European exporters opted to extend their hedges into 2025, pivoting to option-based structures to manage exposures in instances where their directional views were less certain. Notably, this included the use of vanilla options as well as more bespoke solutions, designed to re-strike existing hedges and capitalize on potential continued USD appreciation in the medium term, following the new presidency. The appeal of option-based structures also extended to emerging market currencies, with notable activity observed in EURBRL and USDCLP. Meanwhile, European importers took advantage of periodic bouts of USD weakness, specifically above the 1.04 threshold in EURUSD, to execute their FX strategies.

We also saw a similar uptick in options’ use in North America, particularly from corporates with GBP revenues who utilized options instead of forwards given the overall forward curve remains flat. CNH remained in focus this week – cash flow hedgers locked in longer dated revenue hedges / net investment hedges via forwards as USDCNH dipped below 7.30 while other clients notably came in early to execute their month-end balance sheet rolls ahead of Lunar New Year.

In APAC, the subdued tone on tariffs during President Trump’s inauguration address provided a temporary boost to market sentiment, despite the prevailing expectation among clients that protectionist measures would be implemented in the near term. As a result, many clients capitalized on the USDRMB dip to establish fresh long positions, while others opted to unwind existing short USD exposures. Notably, there was also a discernible pick-up in buying interest in USDHKD.

Rates: Robust European credit markets continue to support a high level of funding-related activity, as issuers take advantage of the current favourable environment. The recent sell-off in long-end rates has prompted a number of UK and European corporates to reassess their fixed-floating ratios, with many opting to swap existing bonds to floating rates. Those seeking to capitalize on the curve have restructured positions in the belly of the curve, securing favourable spreads against original coupons. Pre-hedging bond issuance remains a key theme, with a heightened focus on intra-day risk management to mitigate rates exposure. Furthermore, inflation concerns continue to dominate the agenda among European corporates, particularly in the medium- to long-end of the curve, where break-evens are perceived as attractive and warrant increased attention. In North America, the significant decline in rates, with yields dropping by as much as 20+ basis points since mid January, has created an opportunity for pre-issuance hedgers to lock in rates ahead of anticipated fixed-rate financing. This is particularly evident among large M&A-related deals with substantial value at risk. Despite the pullback in US yields, the rate differential between the US and Europe remains near historic wides, driving sustained interest in net investment hedging, especially with EURUSD rebounding above 1.04. Additionally, the recent closure and funding of several project finance deals in January have led to the execution of required swaps to fix floating rate loan exposures, benefiting from the recent rate decline. New issuance activity has gathered momentum in APAC, with some clients proactively rebalancing their liability exposures in favour of local currencies. Furthermore, event-driven hedging discussions have gained traction, as clients seek to expedite the locking-in of deal economics. Meanwhile, cash-rich clients continue to maintain a strategic USD allocation, demonstrating increased flexibility in pursuing longer-tenor financial investments to capture yield premiums.

Equity: In the equity space, the prevailing themes of the week centred on the structuring of new share buyback programs, slated for launch in the coming weeks following the publication of full-year results. Additionally, hedging strategies for share-based deferred compensation schemes garnered significant attention. Notably, some clients have begun positioning themselves for new equity investments, particularly in European names, which are perceived as attractively valued relative to their US counterparts. U.S. equity-linked activity picked back up, with a handful of transactions tapping the market despite the shortened calendar week, including the very first transaction of 2025. Corporations continue to leverage convertible debt as an efficient and cost-effective means of refinancing existing debt and opportunistically raising capital. We anticipate that the prevailing “higher-for-longer” interest rate environment will catalyse issuance across the spectrum, including from investment grade issuers, who are increasingly viewing the equity-linked market as a viable alternative to traditional debt options. Return of capital continues to be of focus with Corporates preparing for 2025 allocation plans; use of structured strategies remain topical notwithstanding market volatility levels.

Commo: Overall, client activity has been influenced by market volatility, with producers and consumers navigating the complexities of tariff scenarios and price fluctuations, and energy markets assessing potential European gas storage concerns.

The energy markets have indeed been characterized by notable developments, with European natural gas prices experiencing a surge in response to concerns over insufficient storage next winter and Germany’s potential subsidy for filling European natural gas inventories. TTF front-month prices briefly surpassed 50 EUR/MWh. This move has prompted some producer clients to complement hedge programs for exposures in Dutch and German natural gas, while LNG shippers have taken advantage of the European pricing rally to transport US gas across the Atlantic. Meanwhile, the Japanese Korea Marker (JKM) has also seen interest from market participants looking to sell and hedge LNG deliveries indexed to the Asian gas benchmark.

In the metals sector, uncertainty surrounding US tariffs has driven price volatility, with Aluminium and Copper producers capitalizing on elevated price levels by selling via zero-cost collars for the balance of 2025. Alternatively, consumer buying interest has emerged around in Aluminium (around 2,600 USD/mt level), Lead and Copper, suggesting a degree of optimism about future market conditions. In contrast, the US metals market has been impacted by fears of a trade war, with most consumers largely on the sidelines.

EUA compliance buying has slowed in the recent week, as some corporates believe the market rally may have reached its peak.

CORPORATE RISK MANAGEMENT ACTIVITY MONITOR*

* 4-week moving average

WHAT TO WATCH FOR THIS COMING WEEK

US: The US calendar for the week ahead is dominated by the FOMC meeting on Wednesday which we expect to keep its target interest rate at 4.25-4.50% given recent strong labour market data and rising estimates of the neutral interest rate. We also expect the FOMC statement to be largely unchanged.

US Q4 GDP data is scheduled for release on Thursday, with growth of 3.0% q/q saar expected, indicating no loss of momentum from Q3 (3.1%). On Friday, we forecast the annual increase in the Fed’s preferred measure of inflation, the PCE price index, to have risen slightly to 2.5% y/y in December from 2.4% the previous month with core PCE inflation unchanged at 2.8% y/y.

Eurozone: On Thursday, we expect the ECB to cut rates by 25bp, lowering the deposit facility rate to 2.75%. Recent data and the latest statements from members of the Governing Council point to a cut in the coming week.

Q4 GDP data for Germany, France, Italy and Spain will also be released in the coming week. We expect German GDP (out Thursday) to have fallen 0.1% q/q. Meanwhile, we expect French GDP growth to have slowed to 0.1% q/q, as a result of a softer consumption trend following the temporary Olympic boost seen in Q3. January inflation data will also be released for Spain on Thursday, and France and Germany on Friday. Changes in administrative prices at this time of the year could add volatility. For France, we expect the headline trend to have remained stable with HICP inflation at 1.8% y/y.

The ECB lending survey, due out on Tuesday, will provide insight into the effectiveness of monetary policy transmission and whether it has been affected by political uncertainty after the previous month’s relatively strong reading. We will also monitor confidence indicators released throughout the week for the eurozone, Italy and the German Ifo business survey on Monday, in particular, to see if it confirms the upward surprise of last week’s PMIs.

On the political side, in France, an agreement at the joint committee at the National Assembly on Thursday could help to raise the probability of the budget being approved in February. In Germany, the Green party will adopt its election platform on Sunday. The German Chancellor Olaf Scholz and Saskia Esken of the SPD will speak on Saturday, while Friedrich Merz, leader of the CDU, will give speeches on Thursday and Friday.

China: We expect economic momentum to have slowed in January, resulting in a slight decline in the manufacturing PMI, due out on Monday, to 49.9 in January from 50.1 in December.

DISCLAIMER

This communication does not constitute research, a recommendation, or any form of advice from BNP Paribas or its affiliates. It does not consider your financial circumstances or objectives and it may not be suitable for you. It should not be copied or reproduced in whole or in part.

Please refer to the following links for your jurisdiction: Apac disclaimer or Latam disclaimer

Subject to any applicable law, BNP Paribas may use and process the personal data you provide to us in accordance with CIB Data Protection Notice located here: https://cib.bnpparibas/data-protection-notice/ as updated from time to time

If you do not wish to receive the Corporate Weekly highlights from BNP Paribas Global Markets in the future, please unsubscribe here.