The US debt ceiling explained

The debt ceiling is the total amount of money that the US government can borrow to meet its existing legal obligations. The artificially imposed cap was established in 1917 to provide more borrowing flexibility during the first World War, and has been raised more than 100 times since then.

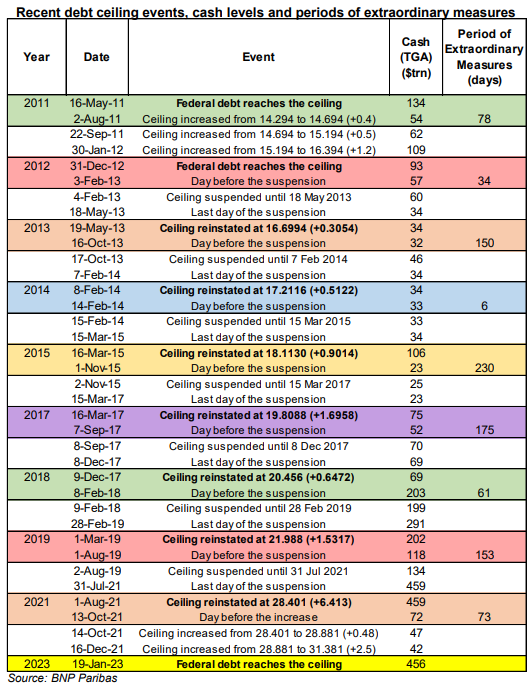

Once the ceiling is reached, Congress must either agree on an increase, or suspend the cap for a defined period of time before it addresses the issue again. During this time, the US Treasury uses ‘extraordinary measures’ to pay its bills and avoid defaulting on its obligations.

These are essentially accounting manoeuvres that allow the Treasury to create headroom between the debt that counts towards the debt limit and the statutory debt limit, and maintain its debt issuance so it can continue to fund its deficit without disrupting markets. If these measures are exhausted with no deal, the Treasury has to limit borrowing and rely on its cash balance (Treasury General Account) to cover its expenses.

At some point during the TGA drawdown, the Treasury Secretary announces the ‘X date’ by which the US government will default on its debt obligations if Congress cannot find a resolution, which has never yet occurred.

It’s happening all over again

On 19 January 2023, the US government breached the current debt ceiling of US$31.4 trillion. Treasury Secretary Janet Yellen immediately notified Congress that the Treasury was employing ‘extraordinary measures’, saying that these plus cash were unlikely to be exhausted by early June.

The difference in 2023 is that concessions agreed between Kevin McCarthy and Republican holdouts in order for McCarthy to be elected as Speaker of the House in January mean that a separate vote is now required to raise the debt limit, rather than an automatic joint resolution to do so when the house passes a budget.

This essentially raises the bar for the debt ceiling to be lifted; McCarthy has so far said the Republicans will not lift the ceiling unless President Joe Biden agrees to spending cuts, while Biden has said he will only discuss federal spending cuts with Republicans after the ceiling is lifted.

Potential repercussions: Although Markets360 analysts ultimately expect a deal to be reached, they see a risk of a drawn-out process and potentially a repeat of 2011, when US government borrowing reached the debt ceiling in May and Congress only agreed to raise the debt ceiling on 31 July, two days before the X date.

Four-week T-bill yields started to price in a default risk ahead of the X date, rising nearly 17bp over a week even with fed funds pegged at the zero lower bound. Net T-bill issuance fell by US$300 billion, with the Treasury’s cash balance falling to as low as US$50 billion.

As net bill supply fell substantially, front-end swap spreads showed a negative correlation due to the lack of short-term collateral pushing down repo rates, widening swap spreads until July.

Two days after the debt ceiling was raised, rating agency S&P lowered the US’s credit rating from AAA to AA+, causing swap spreads to remain tight for some time, while 3m T-bill–OIS spreads widened after bill supply picked up the year after.

While we consider a US technical default a tail risk, the raised bar to lifting the debt ceiling means political wrangling could delay agreement significantly in 2023. If a deal is only reached at the 11th hour, history suggests we could see yields on short-term US debt obligations rise materially

Sebastian Mauleon, US rates strategist, Global Markets BNP Paribas

On 22 February, Washington thinktank the Bipartisan Policy Centre said it expects the X date to fall somewhere between the summer and early autumn. Although they are volatile, significant T-bill inflows before extraordinary measures are exhausted could push back the X date, while large outflows could pull them forward.

BNP Paribas does not consider this content to be “Research” as defined under the MiFID II unbundling rules. If you are subject to inducement and unbundling rules, you should consider making your own assessment as to the characterisation of this content. Legal notice for marketing documents, referencing to whom this communication is directed.