While terms like automation, big data and artificial intelligence (AI) once belonged in the world of Silicon Valley, foreign exchange (FX) market participants are now reaping the benefits of these technological advances to free up time, lower risk and reduce cost.

Smart homes or robot vacuum cleaners usually come to mind with the word ‘automation’, but FX firms are transforming their businesses with sophisticated automation tools to complete pre-trade, execution and post-trade processes in a matter of seconds – tasks that would once have taken hours to complete.

Banks are a key driver of this trend, harnessing automation for their own operations and leveraging the latest technology to develop powerful digital tools such as execution chatbots, algorithms and AI-driven solutions. Moreover, with banks collecting ever greater quantities of data, they now have the potential to innovate even further.

Automation in FX

The automation journey in FX started with execution algorithms for large trades, designed to intelligently read multiple markets in real time and dynamically adjust their behaviour to optimise execution: they have since expanded into new currency pairs and products such as non-deliverable forwards (NDFs). Recently, they evolved into more sophisticated automation with the introduction of multi-currency portfolio and gamma hedging algos.

These latest innovations are helping FX participants automate time-consuming processes and reduce operational risk – in some cases by using AI to improve execution performance.

Gamma Algos BNP Paribas has endorsed more than 10 major universal rights and principles, including the U.N.BNP Paribas recently launched its new Gamma algorithm, which gives clients a fully automated way to manage their gamma profile – previously a manual, time-consuming operation that could lead to human error. |

Innovating through integration

However, creating algos was just the first step in the automation evolution. Finding a way to integrate them seamlessly into a client’s daily workflow was the next challenge.

Services such as Apple Pay, Amazon Pay and Google single sign-on speed up online purchases, removing the need to remember usernames, passwords or manually input addresses and payment details each time. Banks have taken similar steps, building their platforms on OpenFin – the financial industry’s operating system for desktop application deployment – to allow “interoperability” between sell-side and buy-side applications. BNP Paribas also collaborated with Bloomberg to create an app for its FX platform Cortex, allowing direct access to the platform and its features through Bloomberg. This level of integration and user-friendly approach is somewhat similar to the integration products emerging from Silicon Valley.

The rise of big data

With FX execution now almost fully “online”, buy-side clients have become more sophisticated in their capacity to interrogate data. In addition to the emergence of independent Trade Cost Analysis (TCA) providers, banks continue to innovate their proprietary analytics suites, with real-time TCA tools the latest innovation in this space. In a very similar concept to receiving live updates from Google Maps to optimise an itinerary, banks have brought together multiple data sources in real time to show live data throughout the whole trade execution, giving users the ability to adjust an order’s ‘flight path’ and display relevant information along the way.

In-flight tools BNP Paribas recently launched Insight Live, a real-time market intelligence portal that enables clients to track the full execution lifecycle. Insight Live provides clients with essential information about live trades – such as liquidity, volatility and pricing -, giving them greater control of execution and the ability to adjust parameters if necessary. Providing this extra layer of detail on execution and the underlying market conditions is especially valuable as clients continue to work in remote set-ups where the fluency of traditional communications channels is challenged. |

|

AI advancing

Like Silicon Valley, banks are now looking at how they can harness the power of AI to further enhance their offering. One example is by the use of predictive models. Similar to Ocado or Amazon predicting what a consumer might want to add to their shopping cart, banks are using predictive models to evaluate clients’ trading profiles and suggest the most relevant trading axes or identify the research they are likely to be interested in.

Virtual assistants

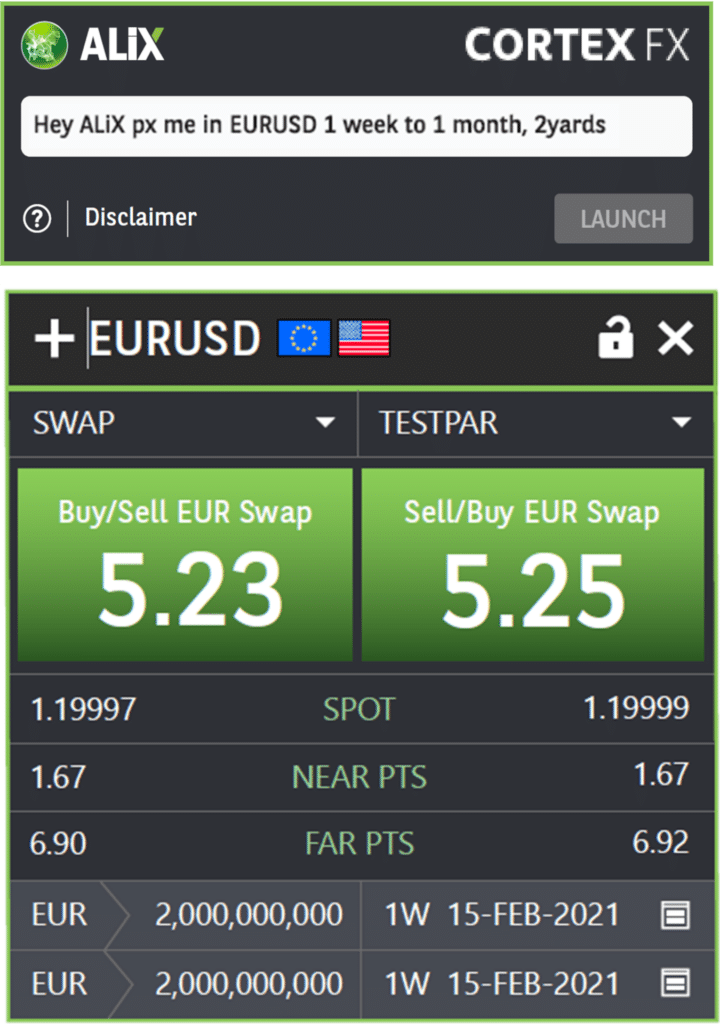

One of the most significant developments to come out of Silicon Valley in recent years is virtual assistants such as Amazon Alexa, and we are seeing similar products in the FX industry. In 2020, BNP Paribas introduced the first virtual assistant that can support clients with their trades, ALiX. Using Natural Language Processing (NLP), users can interact with ALiX in plain English, request information about a trade and give orders it will understand and respond to instantly. Like Alexa, ALiX acts as a gateway to access the bank’s full product suite and can reassure clients who may still be unsure about using machines to execute trades.

Evolution of ALix BNP Paribas has witnessed growing demand for ALiX, which saw a big increase in use in 2020 as clients looked for greater reassurance on their trades in uncertain markets conditions. BNP Paribas has since expanded ALiX across the full FX product suite on the bank’s FX trading platform, Cortex FX, including spot, forwards, swaps, options, orders in addition to algos. The new version of ALiX is available as small widget that fits into the corner of a client’s screen. Read about the latest features |

“With ALiX having expanded its skillset across the entire FX suite, it now offers a true one-stop shop for clients to trade effortlessly via Cortex FX,” commented Nick Hamilton, Head of EMEA eFX Sales at BNP Paribas. “Our clients have had to adapt to new trading environments over the last year, and through listening to their needs, and leveraging cutting edge, innovative technology, ALiX continues to define the next generation of FX trading platforms.” Joe Nash, digital FX COO at BNP Paribas, added, “In an ever evolving and complex market we continually strive to offer clients a bespoke personal trading experience, adapting to their ever more sophisticated needs. ALiX has been designed to fit a world where screen real estate is at a premium and an ever-expanded number of users are working remotely. ALiX has a diminutive screen stature but is indisputably pixel for pixel the most powerful FX platform on the market.” |

Virtual trading assistants are just the start of the AI journey in the FX markets and as the technology evolves, they are likely to become an ever more prominent feature.