Under the theme “QIS in Fast Paced Markets: Converting Uncertainty to Opportunity”, the Forum brought together over 140 participants and clients across Pensions, Insurance, Hedge Funds and Asset Managers. Speakers included institutional clients, members of BNP Paribas’ QIS structuring team and industry peers who shed light on opportunities and challenges within the QIS space in an uncertain market environment.

Each year the BNP Paribas Quant Forum provides valuable insights on current and forward-looking market trends. As a pioneer in the equities space, and with a long-lasting commitment to QIS, we have a deep understanding of our clients’ needs and how to help them navigate volatility.

Nicolas Marque, Head of Global Equites, BNP Paribas

The discussions explored the macro landscape, volatility strategies and insights into quantitative investing when navigating ever-evolving financial markets. Below we summarize some of the key takeaways.

Remarks by Nathalie Texier-Guillot, BNP Paribas

Volatility strategies in a changing market environment

A key theme of the Quant Forum was volatility, with panelists discussing how both market structure and investor strategies have shifted in response to economic uncertainty. With inflation rising, uncertainties around the US presidential elections and tariff changes, volatility is expected to remain high in the near-term. As a result, investors are looking for creative ways to navigate volatility.

Panelists noted the growing interest in short-dated options, as they permit investors to seek to take advantage of near-term volatility while minimizing the impact of longer-term uncertainties. This reflects a broader trend of innovation in volatility trading, with newer instruments and strategies emerging suited to today’s rapidly changing market conditions.

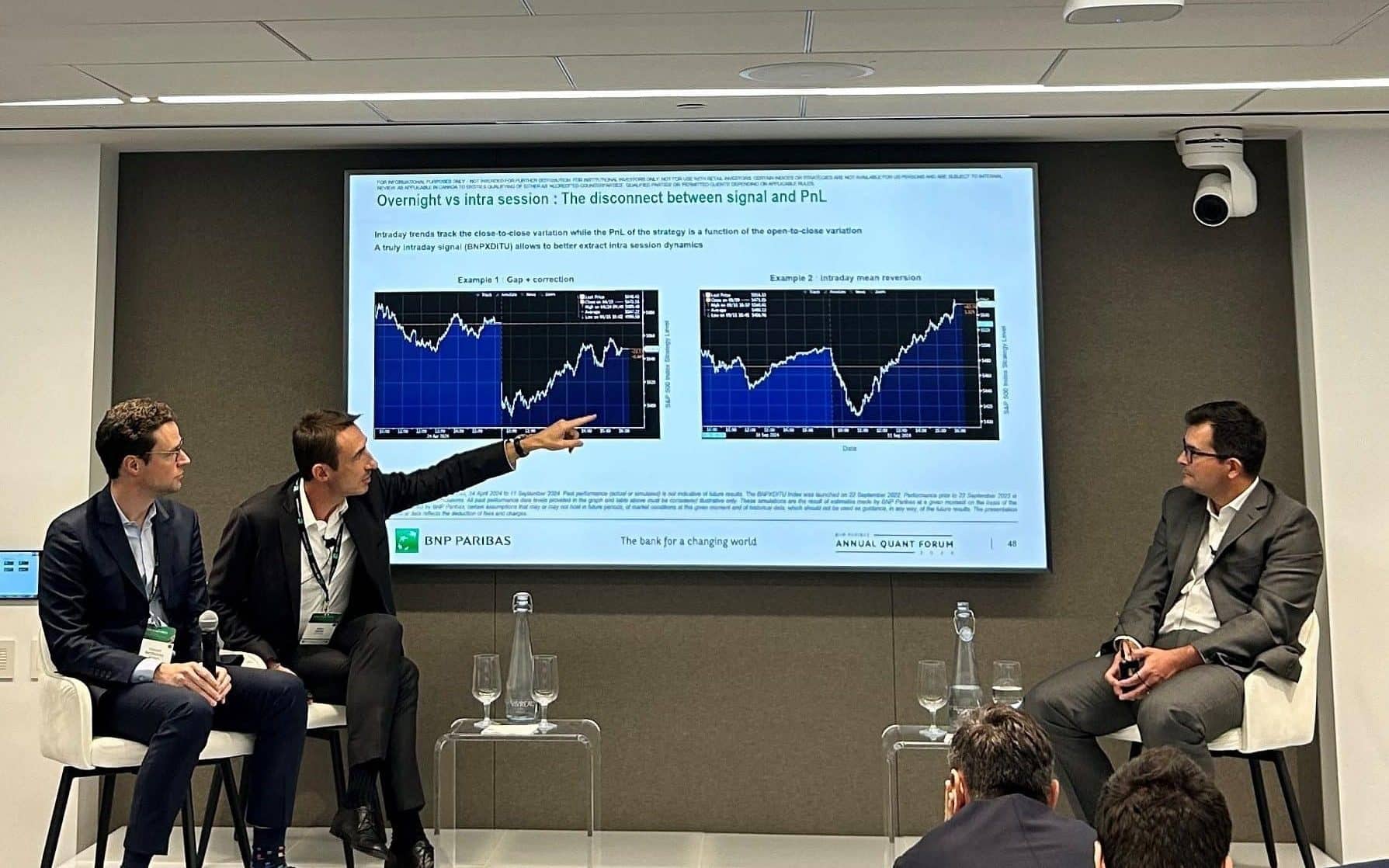

Panel on ‘Volatility strategies and market structure: A new dawn’’

Cross-asset QIS: Pushing the frontier

Cross-Asset QIS allows investors to diversify across different markets and asset classes. Panelists discussed how these strategies are increasingly customizable, enabling asset owners to tailor their portfolios to specific objectives.

Speakers discussed the ongoing development of QIS which continues evolving to encompass a broader range of asset classes and risk exposures.

This focus on customization, is a way for investors to navigate the complexity within markets. Panelists emphasized that as markets become more unpredictable, having flexible and adaptive QIS strategies in place will be essential for institutional investors.

Panel on ‘Navigating the positioning enigma with quantitative investing’

AI as a tool for enhancing investment decision-making

AI is increasingly being used to process vast amounts of data, helping investors better understand market sentiment and make more informed decisions. Speakers highlighted the use of AI for investor sentiment analysis, showcasing how technology can track shifts in sentiment based on data from a variety of sources.

The discussion addressed how AI will likely play an increasingly important role in both traditional and quantitative investment strategies as technology continues to evolve.

Keynote address on predicting “randomness”

A highlight of the Quant Forum was the keynote delivered by Hugo Duminil-Copin, a distinguished mathematician, permanent professor at IHES and key advisor on the French Presidential Council for Scientific Progress. Participants heard the renowned scientist’s insights from his groundbreaking work in probability theory and the concept of “randomness”, underscoring the difficulty of predictability in everyday life. Instead of striving for perfect predictability, participants were encouraged to focus on risk management to navigate uncertainty.

Key note speaker Hugo Duminil-Copin

BNP Paribas leading the QIS market

BNP Paribas is a leader in the QIS landscape with a deep understanding of market dynamics, cutting-edge solutions and structured products tailored to clients’ investment goals.

QIS isn’t just a business for BNP Paribas, it’s in our DNA. We don’t just assist our clients to integrate QIS in their portfolio, we work to create differentiated products that meet the specific needs of their customers.

Nathalie Texier-Guillot, Head of Equity Derivatives Sales & Co-Head of Global Equities Sales, Global Markets Americas, BNP Paribas

As markets continue to be shaped by uncertainty, innovation will be crucial for investors looking to manage risk and find opportunities in a rapidly changing financial landscape. BNP Paribas continues to position itself as a forward-thinking leader in the evolving landscape of quantitative investment.

Disclaimer: This material is for informational purposes only and is not intended to be a complete and full description of the products of BNP Paribas and its affiliates or the risks they involve. Additional information is available upon request. Neither the information nor any opinion contained in this material constitutes a recommendation, solicitation or offer by BNP Paribas or its affiliates to buy or sell any security, futures contract, options contract, derivative instrument, financial instrument, or service, nor shall it be deemed to provide investment, tax, legal, accounting or other advice. All opinions, information, and estimates in this material constitute BNP Paribas’ or its affiliates’ judgment as of the date of this material. This material is only intended to generate discussions regarding particular instruments and financing and/or investments opportunities and is subject to change, or may be discontinued, without notice. This material should neither be regarded as comprehensive nor sufficient for making financing and/or investment decisions, nor should it be used in place of professional advice. You should consult your own advisors about any products or services described herein in order to evaluate the merits, suitability, and financial, legal, regulatory, accounting and tax issues raised by any investment and should not rely on BNP Paribas or its affiliates for this. Information contained herein is derived from sources generally believed to be reliable, but no warranty is made that such information is accurate, complete or fair and should not be relied on as such. The offer and sale of securities to institutional investors may only be made through the U.S. registered broker dealer and futures commission merchant entity, BNP Paribas Securities Corp.