Table of Contents

After a successful T+1 transition in North America in May 2024, the European Union (EU), the United Kingdom (UK) and Switzerland separately announced their intentions to shift from the current T+2 securities settlement timetable to a T+1 settlement cycle, with the target date set for 11 October 2027. In August 2025, Borsa Istanbul announced that Turkish market participants must complete their preparations for the T+1 transition by 31 December 2026[1]. All markets have noted the potential benefits and stated their desire to have a coordinated transition. Despite specificities in the EU, UK and Swiss markets, the general scope and the scope of exemptions are consistent across the three jurisdictions. These are confirmed in the EU, the UK and Swiss implementation plans.

Due to the one-day reduction of the settlement cycle, it is estimated there will be a significant reduction of margin requirements being held at central counterparties (CCPs), which should result in an increase of capital liquidity in the impacted markets. This has been seen as a key driving benefit of the move to T+1, along with the reduction of counterparty risk exposure and increase of automation and standardisation across the post-trade landscape. The alignment of the EU, UK and Swiss markets with industry standards is set to enhance global investors’ perception of the competitiveness of European markets.

The EU, the UK and Switzerland have set up dedicated governance structures and industry working groups to propose recommendations, broken down by criticality, to facilitate a successful transition for industry and participating market members. Operational timetables applicable after the go-live have been released, respectively by the EU T+1 Industry Committee (Industry Committee) mandated by the EU Commission, the UK Accelerated Task Force (AST) and the Swiss Securities Post Trade Council (swissSPTC).

BNP Paribas CIB (through its Global Markets and Securities Services businesses) have been heavily involved in all dimensions of the larger European T+1 journey through active participation in regulatory discussions, industry associations and taskforces. We also have contributed to industry forums to enhance market practices across the European industry.

T+1 in the European Union

The European Securities and Markets Authority (ESMA) delivered its long-awaited report on the shortening of the settlement cycle in the European Union on 18 November 2024. It followed a joint statement by ESMA with the European Commission and the European Central Bank from 15 October 2024, which established a governance structure to accelerate the technical work needed to support a future move to T+1 in the EU. The governance now includes the EU financial industry with the objective to ensure a balanced sectoral and geographical representation.

A legislative proposal by the European Commission to amend CSDR (Central Securities Depositories Regulation) article 5 to shorten the settlement cycle in the EU from T+2 to T+1, first circulated in February 2025, has been the subject of a compromise text. Whilst the scope[2] remains generally unchanged, the amendment to CSDR article 5 has introduced an exemption for securities financing transactions (SFTs). It has also confirmed the possibility for the European Commission to potentially amend and/or suspend the penalty mechanism should there be a risk of market instability resulting from a material increase in settlement fails. The text has been adopted by EU co-legislators and published in the EU Official Journal (OJ) on 14 October 2025 for application on 11 October 2027.

Path to T+1 in the EU: ESMA report and the EU Industry Committee

The ESMA report on the shortening of the settlement cycle was commissioned by the EU co-legislators through CSDR Refit and gave a mandate to ESMA to assess 4 main aspects:

- An assessment of the appropriateness of shortening the settlement cycle in the EU and the potential impacts for market infrastructures and market participants

- The costs and benefits of shortening the settlement cycle in the EU

- An outline of how to move to T+1

- An overview of international developments on settlement cycles and their impact on the Union’s capital markets

ESMA concluded that the settlement cycle should be shortened to the first business day after trades have been executed (i.e. from T+2 today to T+1) while a settlement cycle shorter than that (i.e. T+0) could only be envisaged in the longer term.

The primary driver is global competitiveness. ESMA believed investors may view EU capital markets as less attractive if the EU chose to stay on a T+2 settlement cycle. The conclusion reached by ESMA highlights the benefits of international alignment with other major jurisdictions (especially the US), which has been the impetus for global markets to move to T+1.

ESMA, the European Commission and the ECB (European Central Bank) agreed to put in place a specific governance to help the industry coordinate the move to T+1. An industry committee chaired by Giovanni Sabatini was created and the industry, supported by EU authorities, delivered a high level roadmap on 30 June 2025.

T+1 in the EU: main challenges

| Automation | Significant investment is required to automate processes across the custody chain, from trade execution to settlement. |

| Market fragmentation | The fragmented settlement landscape across the EU and the need for coordination with the UK and Switzerland. |

| Settlement fails | A shorter settlement cycle may increase settlement fails. |

| Securities financing transactions industry | • Lack of overnight repo liquidity on EU markets • Potential material shift of EU repo & securities lending flows to T+0 (same date settlement flows) |

ESMA made several recommendations throughout its report with some expected to translate into regulatory requirements while others are expected to be taken upon directly by market participants.

The Industry Committee picked up from the ESMA report and published a high level roadmap and a list of 59 recommendations with two major imperatives: automation and standardisation across all stages of the post-trade lifecycle.

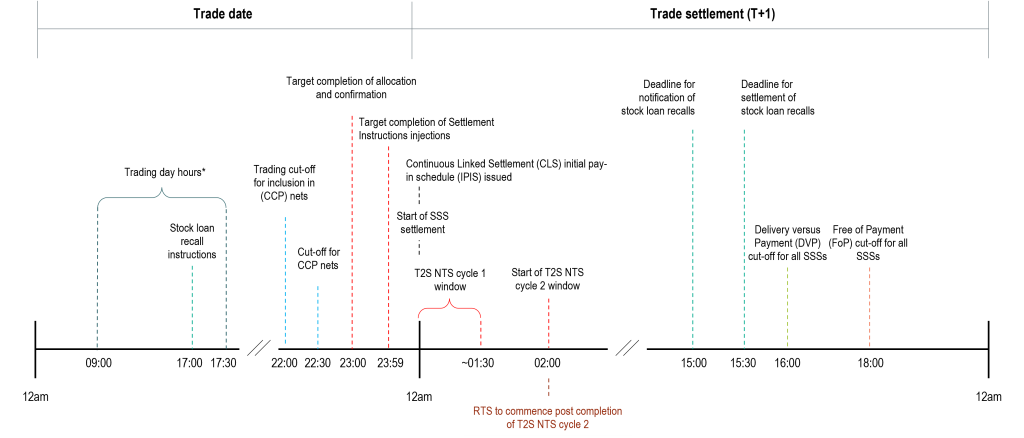

The Industry Committee addressed the scope of T+1, the possible exemptions, the dependencies and proposed an operating timetable designed to address EU fragmentation and allow EU markets to better work together while keeping their local specificities where needed. This is probably one of the most critical aspects to the EU T+1 project for all market participants.

The Industry Committee has proposed a standard operational timetable, with a sequence of key timings (allocation/confirmation cut-offs, securities lending recalls deadline, end of day netting reports, settlement instructions submissions, etc.). Its objective is to further harmonise while allowing flexibility. This translated into the “adhere or explain” principle, i.e. adhere to harmonisation or explain why a specificity is required.

The calendar now foresees additional technical working groups (SSIs, partial settlement, etc.) and the publication of a “user manual” in January 2026 to facilitate implementation during 2026 and testing during 2027.

Market participants are expected to:

- Budget and prepare system upgrades

- Work on the definition of market standards and practices

- Review schedules and functionalities offered by market infrastructures under the “adhere or explain” principle adopted by the Industry Committee

Since the move to T+1 in North America, T+1 in EU markets is increasingly seen by the market and the EU authorities as an opportunity for further harmonisation and standardisation across the Union. The move to T+1 may also prove to be a catalyst for private initiatives and is meant to promote market integration and ultimately, the Savings and Investments Union (SIU) objectives.

T+1 in the EU: timeline

ESMA proposed to move to T+1 in the European Union on 11 October 2027 and identified 3 phases for the transition:

- A planning phase with the finalisation of technical solutions by the industry to be completed in 2025

- A development phase for industry implementation to be completed by Q4 2026

- A testing phase during 2027 until the transition date

On the legislative front, following the publication in the EU OJ in October of the compromise reached by the EU co-legislators, the European Commission will now turn its attention to the level 2 measures proposed by ESMA on 13 October 2025 on amendments to the CSDR RTS on Settlement Discipline[3]. These proposed changes (new allocation and confirmation deadline and updated process, implementation of settlement key functionalities, etc.) are meant to enhance settlement efficiency across the EU and facilitate the transition to a shorter settlement cycle (T+1) by 11 October 2027. ESMA proposed to phase in its implementation to ensure a smooth transition to the new regime.

EU authorities and the financial industry continue to work on the implementation plan (playbook, readiness surveys, etc.) and on the coordination with other European markets to tackle the remaining technical challenges (ad-hoc technical and market specific workstreams) to guarantee a successful transition to T+1.

T+1 in the UK

The T+1 journey in the UK began in December 2022, when the UK Chancellor of the Exchequer launched the Accelerated Settlement Taskforce (AST) to examine the case for, and the practicalities of, moving to a T+1 standard settlement period. Charlie Geffen was appointed as chair of the taskforce and a report was published in March 2024 recommending that the UK should move to T+1 no later than 31 December 2027.

In January 2024, the AST technical group was established. The aim of this group was to outline and develop the technical, operational and behavioural changes necessary for a smooth transition and detail when these changes should be mandated. The group, chaired by Andrew Douglas, was comprised of multiple workstreams covering all aspects of the trade lifecycle.

Fast forward to 2025, the AST technical group published its implementation plan on 6 February 2025 recommending that the UK should transition to a T+1 settlement cycle on 11 October 2027. Instruments and transactions in scope are confirmed in the implementation plan[4].

An Addendum and Erratum to the implementation plan was published in September 2025, reflecting a small number of refinements and clarifications to the February 2025 plan. The changes looked to harmonise the UK and EU plans however also retained the key recommendations to support the UK’s transition.

A key element of the implementation plan is the UK T+1 Code of Conduct (UK-TCC) which should be read by, and applies to, all market participants.

What is the UK T+1 Code of Conduct (UK-TCC)?

The purpose of the UK-TCC is to guide market participants in transitioning to a T+1 settlement cycle as it explains what needs to be actioned and when such action is required (reflects what the UK AST deems to be best practices and operational standards to ensure a smooth and efficient transition). The UK-TCC outlines 12 critical actions (across topics such as scope, settlement, financial market infrastructures (FMIs), static data and securities financing transactions) and an additional 26 highly recommended measures (across topics such as settlement, FMIs, static data, corporate actions, securities financing transactions and FX) with completion dates to maximise the operational benefits of a move to T+1. These recommendations are the T+1 operational changes to market practices which was identified as part of the AST’s 2024 analytical efforts. The AST expects all market participants (UK and non-UK domiciled) to comply with the recommendations to settle efficiently in a T+1 environment.

The UK-TCC also outlines five expected behaviours for market participants which are designed to promote efficiency, accuracy and readiness in the transition to a T+1 settlement cycle:

- Commitment to Compliance: establish processes to measure and verify compliance with the T+1 requirements thus ensuring all parties adhere to the new settlement timelines and standards

- Commitment to Automation: automate processes to reduce manual errors and increase efficiency. This shift towards automation will streamline operations and improve overall accuracy in settlements.

- Commitment to ‘Action This Day’: modify behaviours and have a proactive approach in adopting automated solutions as soon as practicable

- Commitment to Settlement Discipline: ensure high standards of settlementdiscipline and performance to avoid settlement failure and delays

- Commitment to Readiness for Testing: include provision for readiness testing in operational and systems development plans to ensure market participants are prepared for the transition and can handle the new settlement cycle effectively. As of October 2025, the Testing workstream was launched in order to define the testing plan and ensure market and system readiness.

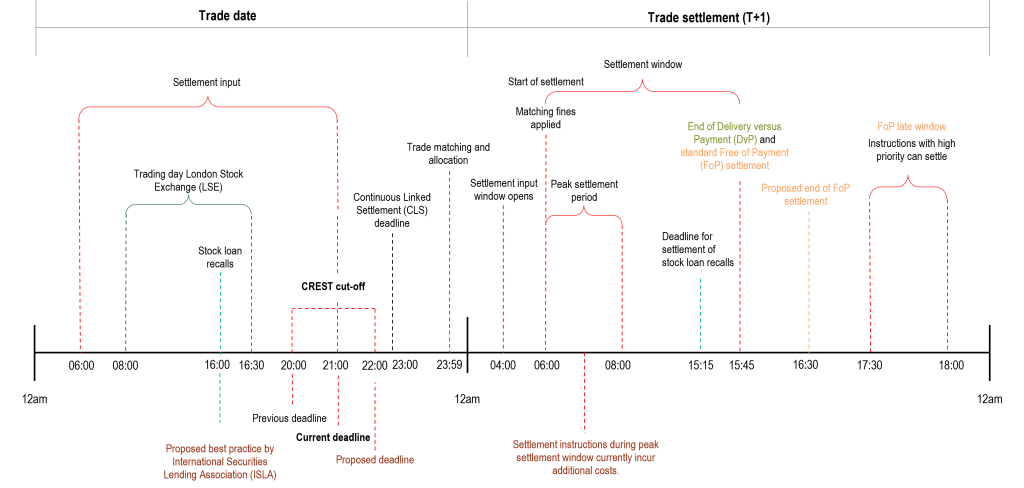

Changes to CREST in the context of UK T+1

Euroclear UK & International (EUI – UK’s CSD) are working on a multi-year transformation programme to upgrade their settlement system (CREST) to a new modular technology platform. EUI will publish its CREST modernisation programme schedule ensuring there are no major platform changes immediately before or after the 11 October 2027 implementation date. The AST has also recommended to prioritise changes that benefit operational efficiency and resilience and implementing them before T+1 where feasible.

In line with the implementation, in a release on 20 October 2025, CREST opening hours for input were extended from 8pm to 9pm UK time to support market participants submitting instructions later should they need to do so.

EUI have also agreed to provide secretariat and communications support to the AST.

UK T+1: next steps

Further to the publication of the AST’s implementation plan in February 2025, HM Treasury confirmed support for the recommendations for the UK’s move to T+1 settlement. The Financial Conduct Authority and the Bank of England have also outlined their support. The primary action for the government is to advance secondary legislation to amend the existing T+2 requirement, under the UK Central Securities Depositories Regulation, to a T+1 requirement. On 20 November 2025, HM Treasury (HMT) published a draft statutory instrument (SI) which outlines how the government intends to legislate to mandate T+1 from 11 October 2027. HMT have also published an accompanying policy note explaining the approach they have taken in the draft SI, both located here[5].

T+1 in Switzerland

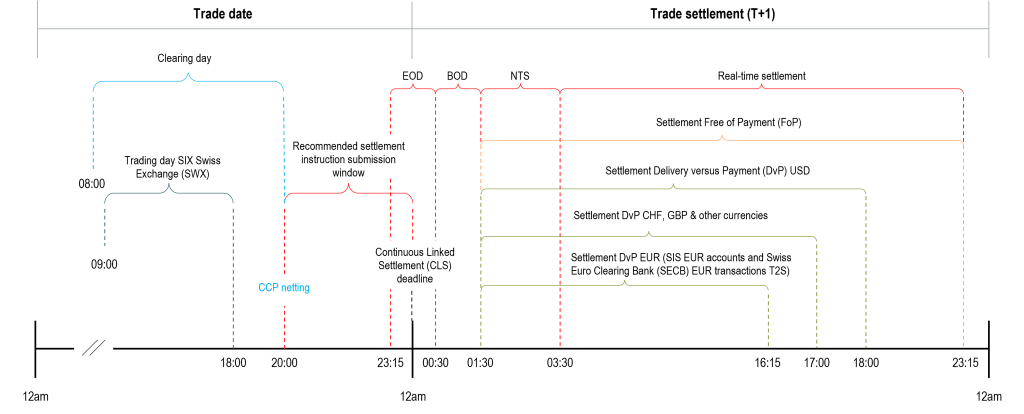

swissSPTC (Swiss Securities Post-Trade Council) is the self-regulatory body which is steering the shift from the current T+2 settlement cycle to T+1 for the domestic market. This follows a charter change (21 March 2024) and a specific T+1 mandate (18 July 2024).

Unlike the EU and the UK, Switzerland does not operate under a Central Securities Depositories Regulation. Settlement rules are self-regulated by industry participants. Liechtenstein, as an EEA (European Economic Area) member, will transpose EU CSDR amendments.

Ongoing discussions involve swissSPTC member institutions (including BNP Paribas), broader support networks (corporate actions and settlement working groups, industry associations) and regulatory bodies (FINMA[6], SNB[7], FMA[8], SIF[9]). Coordination with the EU and UK working groups remains a priority to ensure a harmonised crossborder settlement environment.

On 14 November 2025, swissSPTC published its final Recommendations to the Shortening of the Settlement Cycle paper. Detailed market practices are expected to be published in Q1 2026. As stated by Florentin Solvia, Chairman of swissSPTC, “for each recommendation, a complementary market practice will be created[10]”.

T+1 in Switzerland: next steps

- The swissSPTC Task Force T+1 mandate will last until the T+1 go-live on 11 October 2027

- First swissSPTC proposal with high-level recommendations: January-November 2025 (completed as of 20 November 2025)

- Implementation phase, with definition of market practices to comply with high-level recommendations: November 2025-December 2026

- Testing phase: 2027, until go-live on 11 October 2027

What market participants must do to prepare

The move to T+1 reshapes every stage of the trade lifecycle. Below is a narrative overview of the key operational changes that participants will face.

A compressed settlement window

Cash equities, exchange-traded funds (ETFs) and bonds will have to settle on the business day following trade execution instead of T+2.

Changes to market standards

To facilitate the move to T+1, market standards are expected to change to ensure settlement efficiency is maintained (and potentially enhanced). These include, but are not limited to:

- Corporate Actions

- Standard Settlement Instructions (SSIs): required exchange of quality & automated settlement information using standardised format

- PSET (place of settlement): new mandatory data field PSET to be exchanged at allocation

- ETFs: new EU process that speeds settlement to T+1 by using an “Estimated NAV (net asset value) plus a top‑up”

Changes to allocations and confirmation communication and cut-offs

Both the EU and UK taskforces have recommended allocations and confirmations to be sent as soon as practicable, but no later than 23:00 CET in the EU and 23:59 GMT in the UK on the trade date (T0). In addition to this, they have also recommended enhancements to how this information is shared:

- UK: “Electronically using a recognised industry standard and corresponding data dictionary”[11]

- EU: “Firms are strongly encouraged to adopt electronic standardised communication methods for the exchange of allocations and confirmations to support straight-through processing (STP)”[12]. In the EU, the cut-off and electronic exchange are expected to become a regulatory requirement under the new Settlement Discipline proposal noted in the EU section above.

Process and system upgrades

Legacy infrastructure that still depends on manual checks or paper confirmations will no longer be fit for purpose. Market participants should consider their legacy systems and potential upgrades or changes to meet the regulatory obligations.

Night‑time batch re‑timing

The EU Industry Committee recommends moving the overnight batch cycle (NTS) back by 3.5 hours, effectively to 23:59 CET. This shift creates enough headroom to meet the new cut‑offs and to feed the settlement‑instruction feed into the clearing and settlement systems in time for the next‑day settlement. Participants should therefore review the scheduling of all batch jobs and consider moving to real‑time or near‑real‑time processing where feasible.

Increased liquidity pressure

With a tighter settlement window, the need for funding on the settlement date becomes more acute. Counterparties may experience a higher demand for cash or repo financing to cover their positions. It is therefore prudent to examine existing liquidity buffers, explore repo and securities financing facilities, and, where appropriate, consolidate cash pools across legal entities.

- FX: clients should also be aware of the pressure on sourcing FX to support settlement and consider internal processes or existing market solutions to meet their needs.

Settlement optimisation becomes essential

Tools that shape settlement flows—such as “hold‑and‑release” mechanisms, partial settlement, intra‑day netting and trade‑compression services—should be considered to mitigate the risk of settlement fails and ease the pressure on liquidity.

Conclusion

At BNP Paribas,we are actively involved in ongoing dialogues with stakeholders and industry bodies to ensure alignment across the full trade lifecycle. We are also evaluating the broader impact on all client segments to help them adapt their operating models and avoid higher settlement fails, overdraft charges, and counterparty frictions. For a detailed, client‑specific roadmap or to discuss how BNP Paribas can support your T+1 journey, please reach out to your relationship manager.

[1] Shortening the Settlement Cycle for Instruments Traded on Borsa Istanbul Equity Market | Borsa İstanbul A.Ş.

[2] Both the EU T+1 Industry Committee (Industry Committee) and the UK Accelerated Settlement Taskforce (UK AST) have published a detailed scope matrix in their respective recommendations:

- EU – High-level Roadmap to T+1 Securities Settlement in the EU (refer page 9).

- UK – UK Implementation Plan for first day of trading for T+1 settlement (refer page 23)

[3] ESMA final report on amendments to the RTS on settlement discipline

[4] UK Implementation Plan for first day of trading for T+1 settlement (refer page 19)

[5] https://www.gov.uk/government/publications/accelerated-settlement-t1

[6] Swiss Financial Market Supervisory Authority

[7] Swiss National Bank

[8] Financial Market Authority Liechtenstein

[9] State Secretariat for International Finance

[10] Publication of the Final Set of T+1 Recommendations – Market Update III

[11] UK Implementation Plan for first day of trading for T+1 settlement (refer page 28)

[12] High-level Roadmap to T+1 Securities Settlement in the EU (refer page 21)