In 2023, over 10 million EVs were sold globally – a 30% increase on the previous year, putting the total number of electricity-powered cars on the road to 30 million. One of the key developments noted by some of the world’s top industry practitioners at BNP Paribas’ second annual Global Electric Vehicle and Mobility Conference in Hong Kong was that EV costs are continuing to decline, while new technologies are coming to market, amidst an uptick in growth.

“The EV and battery space is on the cusp of significant change. From the way we power our cars, to the way we drive them, to the brands that make them and the companies that supply them, everything is to play for. We will see technological developments throughout the value chain, with implications beyond the automotive space,” said Stuart Pearson, Global Head of Automotive Research at BNP Paribas Exane.

The EV and battery space is on the cusp of significant change. From the way we power our cars, to the way we drive them, to the brands that make them and the companies that supply them, everything is to play for.

Stuart Pearson, Head of Automotive Research, BNP Paribas Exane

Plugging the (affordability) gap

Inflation, higher interest rates and reduced subsidies have resulted in EVs being an expensive choice in most markets. However, rapid and extensive cost reductions are being made across the entire EV value chain, both in China and Europe, where manufacturers are also making significant progress as they leverage gains throughout the global value chain, harness rising EV scale, and bring their respective technologies to market. As cost reductions across the value chain combine, price parity with Internal Combustion Engines (ICE) is expected to be within reach by 2028, driving mass adoption, according to BNP Paribas Exane estimates.

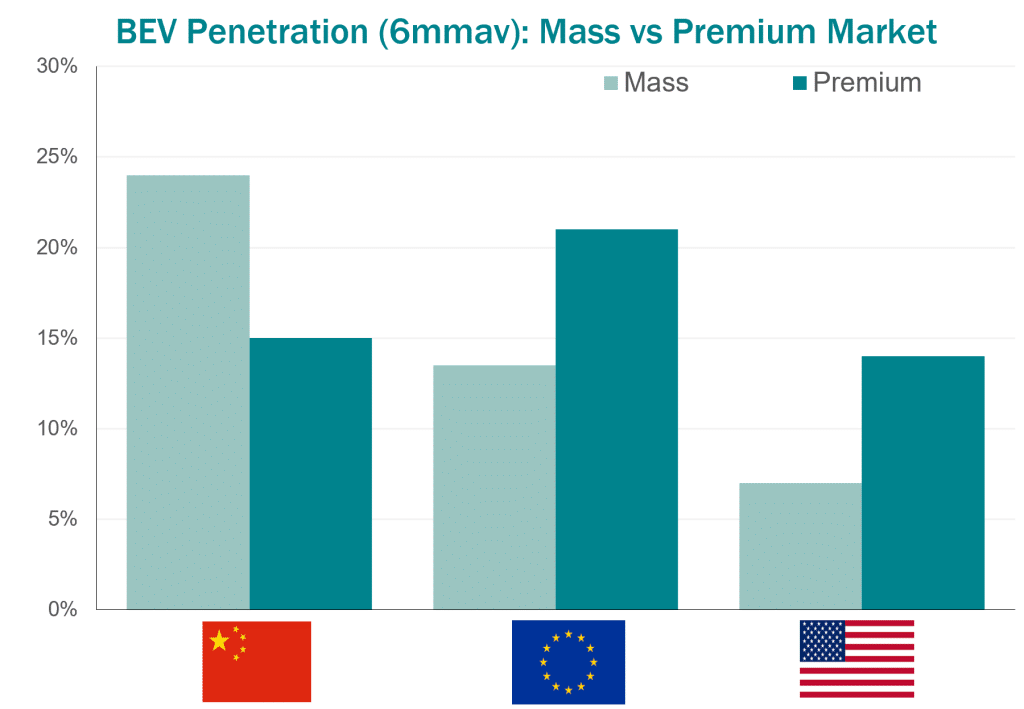

Dorothee Cresswell, Head of European Automotive Research for BNP Paribas Exane, said: “The low-cost market is the most interesting space to watch. This may be well developed in China, but in Europe and the US, EVs are a premium affair. That is set to change as a raft of affordable models come to market, supported by lower cost battery chemistries and advanced manufacturing techniques. That’s important, as if the entry ticket to battery electric vehicle (BEV) ownership can drop to USD25,000, it should double the global addressable market versus today.”

“It is one of the fastest technological growth stories of the coming decade. As a result, we are set to see growth some 4x faster than even that witnessed in the semiconductor space over the past few decades, with a trillion dollars in capex supporting a potential 500+ billion-dollar revenue opportunity by 2030,” added William Bratton, Head of Cash Equity Research, APAC at BNP Paribas.

It is one of the fastest technological growth stories of the coming decade. As a result, we are set to see growth some 4x faster than even that witnessed in the semiconductor space over the past few decades, with a trillion dollars in capex supporting a 500+ billion-dollar revenue opportunity by 2030.

William Bratton, Head of Cash Equity Research, APAC, BNP Paribas

China and Europe – leading the way

Two markets, China and Europe, account for 80% of the world’s EV sales. China on its own has just under a 60% share, as the country continues to lead the way in the shift away from ICE. Nearly a third of the vehicles sold in the country are BEVs.

Europe is currently a key export market for Chinese EV auto firms, but changes in tariff policies may have an impact.

Another development to look out for is industry consolidation in China, according to experts speaking at the conference in Hong Kong. The market is highly competitive with many companies jostling for market share – including traditional car companies, EV-specialists, and even technology firms. A price war is the inevitable consequence of so many companies in the market, which will result in those who are successful increasing their share as others leave the market.

Supply chain and EV efficiency

EV supply chain considerations also continue to play a key role.

“Supply chains are a key part of the EV story, as they continue to evolve globally. It has yet to be seen whether they will develop into globalised networks of companies, or whether we will see several regionalised supply chains,” said Jean-Christophe Vallat, Managing Director, Head of Industrials & Consumer at BNP Paribas.

One component of the supply chain deserves special attention: the car battery. Improving the efficiency with which EVs use each kWh of battery capacity is key to the drive towards cost parity.

“Accounting for around one third of total costs, batteries are perhaps the most important EV component, and improvements in the production process will help drive down overall costs, making EVs more attractive to the end consumer,” said Kenneth Quinn, Head of Industry Groups and Co-Head of Low Carbon Transition Group, APAC at BNP Paribas.

As new battery chemistries meet rising scale effects and innovative manufacturing techniques, average battery pack costs will fall by almost 30%, according to BNP Paribas Exane estimates. Meanwhile improved vehicle efficiency and moderating range requirements as infrastructure expands, should cap – and perhaps reverse – the trend towards larger battery packs. This, together with scale and next-generation-platform driven savings on non-battery costs, should combine to also drive BEV costs down by 30%.

Heading in the right direction

By 2028, mainstream BEVs are projected to have reached cost parity with ICE, according to BNP Paribas Exane. By this stage, regulatory push is expected to be less of a driver, while consumer pull should be more effective, as long as there is sufficient infrastructure in place.

Source: EV Volumes

“Interest in all things EV and Mobility remains very strong; and in many ways the journey has just started. Pricing and range anxiety have been hot topics however the speed of innovation looks to be narrowing the gaps to ICE very quickly indeed,” said Jason Yates, Head of Cash Equities, APAC at BNP Paribas.

Meanwhile the development of charging infrastructure is set to help relieve range anxiety as each market works out the most effective network that fits their particular situation to ensure that drivers have easy access to a charging point.

Innovation powers ahead

The development of the EV industry also coincides with the advent of AI-powered autonomous driving solutions, which could become a standard feature for cars over the coming years.

Brian McCappin, Deputy Head of Global Markets and Head of Institutional Clients Group APAC, at BNP Paribas, said: “There is already enormous innovation in the EV industry, which bodes well for its future development as one of the key sectors in the transition to net zero. The continuation of this trend is essential if the world is to meet its sustainability targets.”

In the sustainable bond markets with over USD4 trillion worth of cumulative issuances, clean transportation has seen significant investment, from mass transportation such as high-speed trains to EV productions, from innovative battery solutions to large scale charging infrastructure.

“With Asia’s EV markets outpacing conventional ICE vehicles in sales, together with competitive industry technology and manufacturing capability, plus favourable policies, the sector as a whole is promising as a growth story, a clean tech story and a climate story,” said Chaoni Huang, Head of Sustainable Capital Markets, Global Markets APAC, BNP Paribas.

With Asia’s EV markets outpacing conventional ICE vehicles in sales, together with competitive industry technology and manufacturing capability, plus favourable policies, the sector as a whole is promising as a growth story, a clean tech story and a climate story.

Chaoni Huang, Head of Sustainable Capital Markets, Global Markets APAC, BNP Paribas