Swiss franc bonds take centre stage

Traditionally a safe haven, the past decade has seen a dearth of CHF issuance. This is changing. Issuers and investors are seeing opportunities and diversification.

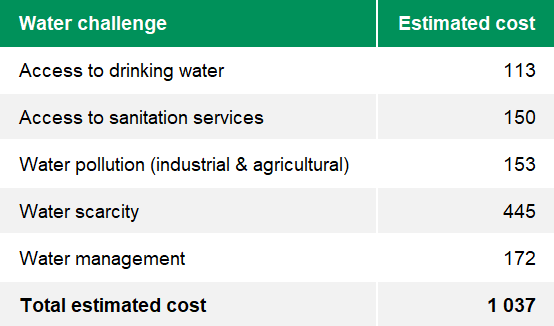

Delivering water for all is estimated to need investments of over US$1 trillion in the next decade. How can we ensure access to water as a critical life resource?

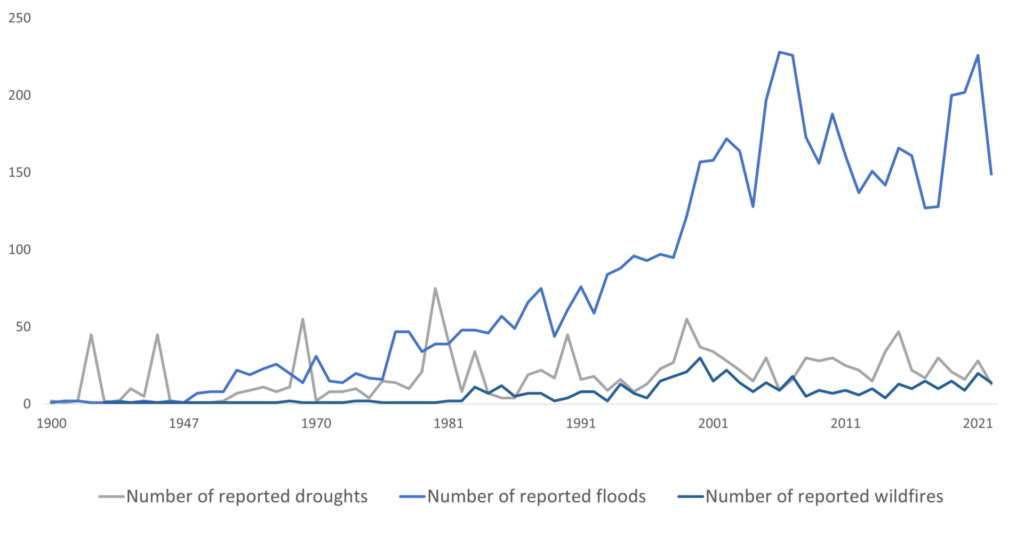

Water is the building block for life and acknowledged as a human right by the United Nations (SDG 6). However, climate change has led to higher average temperatures, accelerated desertification, and increased the frequency of more extreme droughts, putting access to water at risk.

Source: UN FAO, AQUASTAT, EM-DAT, WWF, WRI Achieving abundance, Zoological Society of London, BNP Paribas Markets360, “Sustainable water from trickle to torrent“

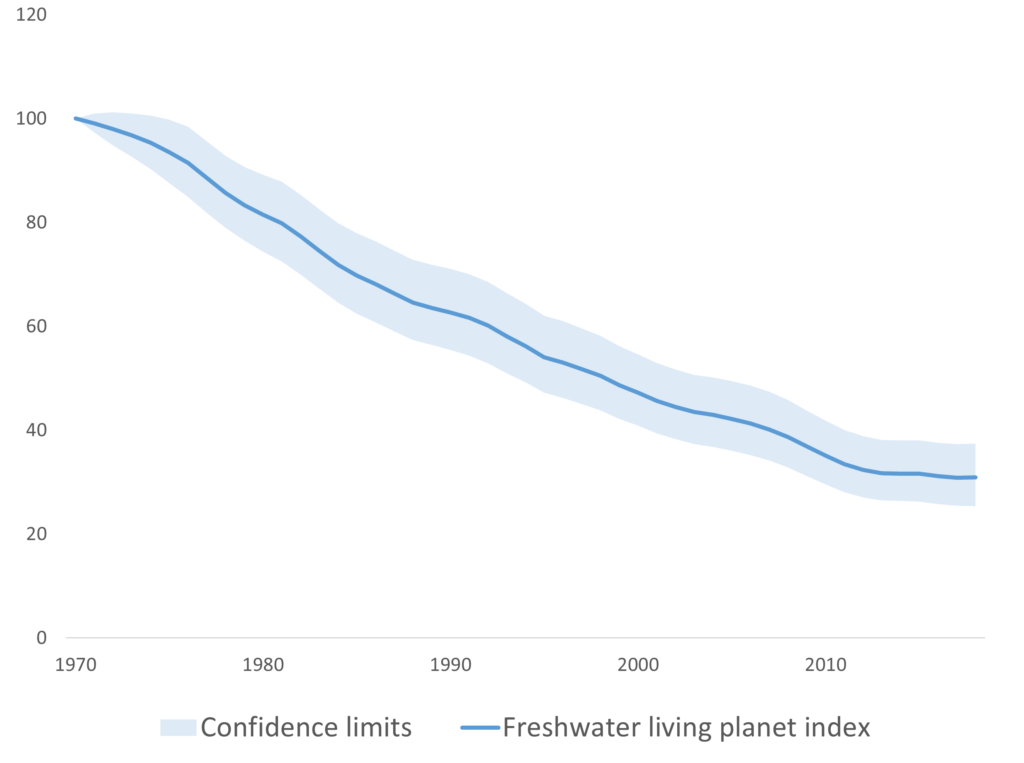

Analysis by BNP Paribas Markets 360 shows that between 1962 and 2018, world renewable freshwater sources fell by 60%, while according to UNICEF, at least two billion people rely on contaminated drinking water sources and 4.2 billion lack safely managed sanitation services.

The index tracks changes in relative abundance of freshwater vertebrae populations over time

Source: UN FAO, AQUASTAT, EM-DAT, WWF, WRI Achieving abundance, Zoological Society of London, BNP Paribas Markets360, “Sustainable water from trickle to torrent”

Unsustainable water management, linear business models, and historic lack of maintenance and investment have led to antiquated infrastructure and high leakage rates, with leaking pipes estimated to cost society US$39 billion annually. The World Resources Institute projects the cost of delivering sustainable water management for all countries and major basins to US$1.04 trillion annually from 2015 to 2030.

Source: UN FAO, AQUASTAT, EM-DAT, WWF, WRI Achieving abundance, Zoological Society of London, BNP Paribas Markets360, “Sustainable water from trickle to torrent”

As the pressure increases on scarce water sources, promising new technologies are emerging, ranging from water filtering to remove unwanted elements, to the alternative use or reuse of wastewater and sewage.

One of these new technologies is the transformation of sea water, or brackish water, into potable water through desalination.

❝ While traditional techniques have tended to be carbon-intensive, new, more environmentally friendly desalination solutions are emerging. ❞

In 2023 BNP Paribas supported the construction of the Mirfa 2 RO Project, a desalination plant using reverse osmosis technology, by acting as mandated lead arranger, offshore and onshore account bank, and financial advisor in the US$507 million limited recourse financing of this independent water project in the United Arab Emirates.

Tackling adaptation risk from water stress is critical to building a resilient economy. South Korea has long prioritised sustainable approaches to water management. In August 2023, supported by BNP Paribas, the Korea Water Resources Corporation, issued its inaugural Swiss Franc denominated green bond. The net proceeds will follow the guidelines set out in their Green Financing Framework, and includes investments in water safety, water sharing and water supply, aligning with SDG 6. BNP Paribas acted as sole lead manager on the offer.

Equally, the State of Israel has long prioritised sustainable approaches to water management. In January 2023, BNP Paribas supported the country on a debut US$2 billion 10-year green bond. Recycling more than 90% of its wastewater, its Green Bond Framework includes a dedicated sustainable water and wastewater management category. The net proceeds from the green bond offering will be allocated to projects under its national green bond framework, including the construction, extension, operation, and renewal of water and wastewater collection, treatment and supply systems. BNP Paribas acted as joint lead manager and joint green structurer on the offer.

Guaranteeing access to safe drinking water and sanitation across the European Union was embedded in EU law in 2020. However, to achieve complete service coverage, tackle water stress and reduce leakage, the Organisation for Economic Co-operation and Development (OECD) estimates that the European Union will need to invest up to €90 billion per year by 2030. In Italy, defining sustainable paths to responsible and conscious water management models is crucial to the country’s economic revitalisation plans. In its latest whitepaper, the Value of Water for Italy initiative demonstrated that without water, 18% of Italian GDP would not have been generated. BNP Paribas supported the Italian government in the issuance of its inaugural green bond in 2021, which includes a use of proceeds for sustainable wastewater management.

At the more regional level, Hera Group, the Emilia Romagna based multi-utility, is accelerating its water investments, announcing a substantial increase in spending to upscale its treatment capacity in its latest five-year plan. In May 2022, Hera issued a seven-year €500 million green bond to finance and refinance a variety of green projects, including expenditures to build and extend water and wastewater collection, and treatment facilities. The issuance was supported by Hera’s EU Taxonomy aligned Green Financing Framework, and BNP Paribas acted co-ESG structurer and joint lead bookrunner.

Beyond Europe, the Government of Peru and the United Mexican States recently issued sustainable bonds, supported by BNP Paribas, which will drive investments to efficient and resilient water and wastewater management, amongst other SDG areas. In Vietnam, the World Bank (IBRD) mobilised private capital through the issuance of an emission reduction-linked bond to provide drinking water for up to two million children. Partnering with the World Bank (IBRD), the African Trade Insurance and a consortium of international lenders, BNP Paribas structured a US$910 million financing to construct water systems, consisting of a water treatment plant, transmission pipes, storage, and distribution facilities, assuring supply of potable water to fast-growing urban communities in Sub-Saharan Africa.

“Access to clean water and the impact of human activity on offshore biodiversity is at the centre of developing work from the Science Based Targets for Nature. This will eventually help deepen further the measures put in place by companies to tackle those issues. In the context of the sustainable bond market, thematic use of proceeds bonds following the ICMA Principles, such as blue bonds, have gained further traction recently with a clear investor interest to identify more prominently investments in those areas,” says Agnes Gourc, Head of Sustainable Capital Markets, BNP Paribas.

❝ Access to clean water and the impact of human activity on offshore biodiversity is at the centre of developing work from the Science Based Targets for Nature. This will eventually help deepen further the measures put in place by companies to tackle those issues. ❞

Global population growth will put further pressure on water supplies, as a source for drinking, for food supplies and for industrial uses; estimates suggest that the demand for water will increase by 30% by 2030. Anne Van Riel, Head of Sustainable Finance Capital Markets Americas, BNP Paribas, spotlights the role of the private sector: “To address the rapidly emerging water crisis, private sector participation is essential. Corporates are increasingly addressing their responsibilities for impact on water systems, from working with local communities to reducing the impact of industrial water. At BNP Paribas, we can help them identify the right commercial opportunities and find the right long-term financing solutions.”

❝ Corporates are increasingly addressing their responsibilities for impact on water systems, from working with local communities to reducing the impact of industrial water. ❞

Around the world, companies are increasingly taking responsibility for the impact on water systems and the local communities within which they operate, tackling critical water issues that impact their supply chain. In April, the US-headquartered manufacturing solutions provider Jabil, with locations in 30 countries, announced the publication of its new Green Financing Framework along with a US$500 million refinancing of senior unsecured five-year fixed green notes. In its new framework, Jabil included several ICMA Green Bond Principles aligned eligible expenditure categories, including sustainable water and wastewater management. BNP Paribas acted as co-sustainability structuring advisor, marketing coordinator and joint active bookrunner for Jabil’s financing.

In August 2022, US semiconductor manufacturer Intel Corporation raised US$6 billion in five senior benchmark trades, of which US$1.5 billion in green bonds, led by BNP Paribas. Intel has an overall net-zero water goal and the proceeds from the green bond are to finance eligible projects, investments or expenditures which include projects related to sustainable water management and water stewardship.

BNP Paribas does not consider this content to be “Research” as defined under the MiFID II unbundling rules. If you are subject to inducement and unbundling rules, you should consider making your own assessment as to the characterisation of this content. Legal notice for marketing documents, referencing to whom this communication is directed.

Traditionally a safe haven, the past decade has seen a dearth of CHF issuance. This is changing. Issuers and investors are seeing opportunities and diversification.

Asia Pacific is leading the world in energy transition and emerging as the second-largest green bond issuer behind Europe.