The dollar bond market has taken an upturn over the past months as a source of funding for European companies, having previously dipped during recent economic and interest rate turmoil.

European companies’ dollar issuance has already returned to the long-term average of 25% of their bond funding, and this share is expected to grow.

In a recent virtual round table feature in Global Capital, BNP Paribas CIB experts Giulio Baratta and Tim McCann take a deep dive into this market and its main trends, and outline their vision for 2024.

An important market

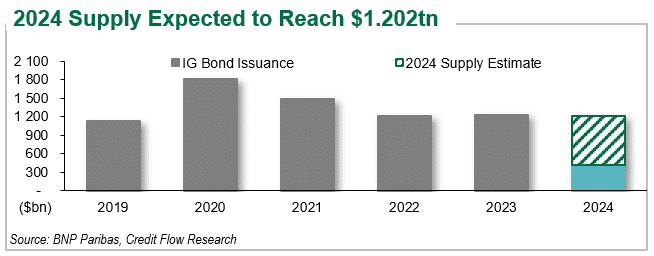

Giulio Baratta, Co-head of IG finance EMEA, BNP Paribas, explains the size and importance of the dollar bond market for European corporates: “In 2023 European companies have raised in debt capital markets about €400bn-equivalent. Twenty six percent of that is dollar public funding, and more or less twenty five percent is an average proportion for the past five years. We think it’s going to grow, because through the volatile cycle over the past 12 months, dollar demand and capacity has been very resilient.”

❝ In 2023 European companies have raised in debt capital markets about €400bn-equivalent. ❞

Tim McCann, Head of US investment grade syndicate, BNP Paribas, also highlights the significance of this market: “The Yankee corporate market accounts for about $105bn this year, just shy of 10% of the investment grade dollar market. So it’s quite significant. […] The dollar market offers access to deep liquidity, duration, large, strategic M&A trades and investor diversification.”

❝ The dollar market offers access to deep liquidity, duration, large, strategic M&A trades and investor diversification. ❞

Timing is crucial

Supporting clients to find the right market opportunity is crucial, and McCann notes that timing is a key component for certain issuers. Working with a trusted partner is vital find the best window: “For corporate issuers that are much more infrequent, picking the right currency, the right timing, the right market is all very important. […] So we do spend a lot of time advising clients on finding that right market opportunity. […] It’s really finding that optimal day to do the deal.”

Opportunities for European borrowers

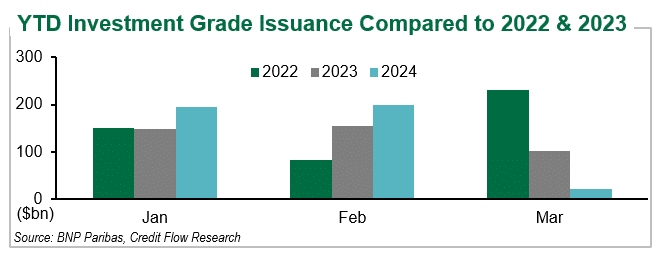

In the current environment, the American market offers strong opportunities for European borrowers. Baratta notes: “There is a conviction that we are facing a smoother correction of the economy, as opposed to a deeper or riskier recessionary scenario. We are approaching the end of the tightening cycle in a smooth way, which is clearly indicating that at least the short to mid part of interest rate curves should ease a little bit. But credit spreads, especially on the long end, are remaining fairly tight. It is a very good, broad market window for borrowers to derisk their refinancing and raise funds across the board of maturities. This is exactly where the American market offers a great opportunity to European borrowers.”

Looking ahead

Our experts think that 2024 will be an interesting year for this market, as Baratta explains: “The combination of the outlook for the market in 2024 and the breadth of potential demand will make for a very interesting year in the further growth of the use of the dollar market for European companies. American companies are giving us a great example on how they are using that flexibility and breadth of demand.”

Looking beyond, some change can be expected in the coming years: “Our day-to-day jobs will evolve dramatically over the next few years. I am extremely confident we will still all be here as good advisers to our firms and counterparts, but the way we’ll be executing transactions is set to evolve. We are investing a lot in better, faster and more reliable systems and developing more advanced AI content support provisions. The backbone of the origination and distribution architecture of DCM is set to evolve very dramatically.”