Since the Covid-19 pandemic, AI and generative AI in particular have accelerated incredibly fast. Markets 360 experts predict three major impacts due to AI:

- A potential 1pp productivity boost by 2030

- Uneven distribution of benefits, with advanced countries better positioned to lead on AI

- A potential reduction in inflation of up to 1pp a year

I. AI could boost productivity by 1pp before 2030

Historically, a new technology has always needed time to be adapted and have an impact on the global economy. For example, the invention of personal computers in 1970s didn’t have an impact on productivity before the 1990s.

However, Markets 360 analysts believe that the adoption of AI and its impact on the economy will be felt much sooner, most likely by the end of the decade.

- The speed of adoption of new technologies has been accelerating over time, from a matter of decades to one of years.

- The digitalisation of the economy also significantly accelerated due to Covid, increasing capabilities to deploy AI across the economy.

- Corporates are incorporating the new technology quickly and, according to industry experts, there could be mass adoption in the coming two to five years.

- Global corporate investment in AI has increased by a factor of more than 10 over the past decade. This is usually a good leading indicator for productivity gains ahead. Strong financial support from governments, with the EU NGEU or US CHIPS Act, also improves medium-term incentives for investment.

Although there is uncertainty about the potential impact, analysts think that AI could bring 1pp productivity growth gains by the end of the decade.

II. Advanced countries are better positioned to lead on AI

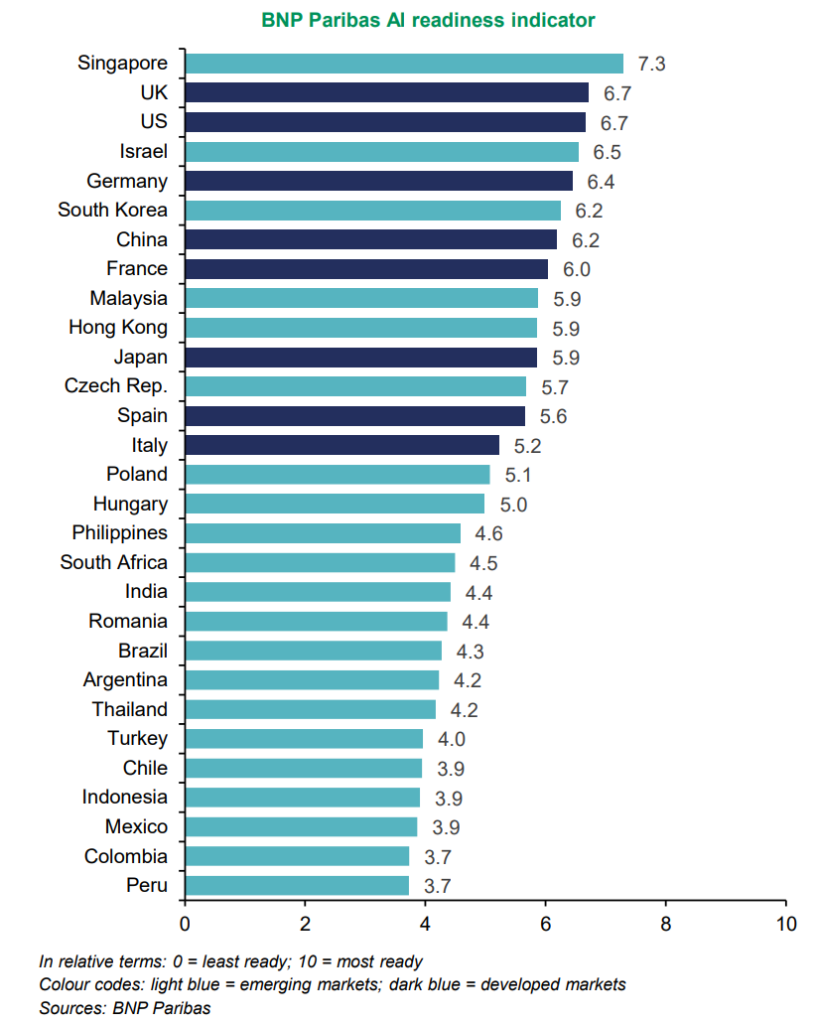

The benefits of AI are likely to be unevenly distributed across countries, at least in the short to medium term.

Markets 360’s AI readiness indicator suggests that more developed economies tend to be better placed to exploit AI, with Singapore ranked first, followed by the UK and the US. Major European countries and parts of Asia, such as China and South Korea, are immediate followers, while South American countries are towards the bottom of our sample.

Thanks to globalisation, emerging economies have grown faster than developed ones over the past century, resulting in a convergence of living standards. The risk of deglobalisation coupled with the unevenly distributed impact of AI could suggest more challenging times ahead for EM relative to advanced economies.

III. AI could reduce inflation by up to 1pp a year

The analysts’ macroeconomic modelling suggests that when AI increases labour productivity by 1pp per year, it should lower annual inflation by around 1pp. However, this assumes other things remain equal. Monetary and fiscal policy can work to offset lower inflation rates and other structural trends, such as de-globalisation, de-carbonisation and population ageing are likely to act in the opposite direction and put upward pressure on inflation. The impact on inflation is likely to be particularly significant as AI technology improves and becomes more widely adopted.

Given different rates of AI diffusion, country dispersion could be wide. There should be a greater disinflationary impact in developed markets, including China, than in emerging markets.

Whereas globalisation has mainly reduced price pressures in manufactured goods, AI technology should mainly reduce price pressures in services. In the US, Markets 360 analysts estimate that lower service prices could contribute to two-thirds of the drop in inflation that we project over the coming decade. However, the timing of the disinflationary effect is uncertain. Other forces, such as deglobalisation, decarbonisation and the ageing of the population, are likely to play in the other direction.

| AI looks set to have an undeniable impact on the global economy, but its full effects are still hard to predict. While the overall story is one of potential for higher productivity and lower inflation, the research team sees some economies in a better position to adopt AI than others, already highlighting likely leaders. |

Reach out to your BNP Paribas sales representative to enquire about Markets 360 research