In a discussion focusing on the next stage of the equity recovery, quant and equity experts joined moderator Greg Boutle, US head of equity and derivative strategy at BNP Paribas, to discuss the main dynamics currently shaping developed market equities. [1]

US election impact

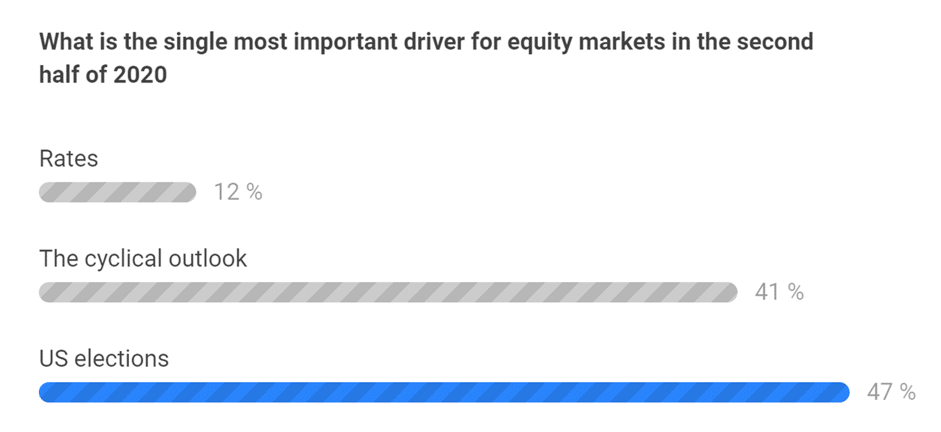

An audience poll found 50% of listeners believed the upcoming US election would be the most important driver behind equity market movements during late 2020. One panellist said the election could yield three potential outcomes. His first scenario – namely a President Trump victory coupled with a Democrat majority in the House of Representatives – might result in a brief but significant “risk-on” rally (where stocks are preferred over bonds) as it would alleviate some of the uncertainties investors are wrestling with, he said. His second scenario – a Biden presidency, but kept in check by a Republican-controlled Senate – might also culminate in a brief risk-on rally as some of the more radical tax, regulation and corporate governance reforms would most likely be avoided. The panellist also thought a Biden presidency might lead to a more constructive US dialogue with China, appeasing global investors further.

The third and final potential outcome – a Democrat victory including the executive and both legislative branches of government – carried a number of risks and opportunities, the panellist commented. He said industries such as health, energy and financials would see a lot of change, fuelled by regulatory reform, increased corporation taxation and the introduction of a higher minimum wage, all of which would be likely to have an impact on earnings estimates in 2020. Despite these near-term risks, the panellist argued that now was not the time for investors to sell and move into cash. There were, he added, a number of potential upsides to a Democrat sweep. For instance, it could result in a larger and more targeted fiscal stimulus package, leading to Gross Domestic Product growth and heightened inflation expectations. This could support attractive opportunities in sectors like industrials.

In the run-up to the November US elections, opportunities might also arise in selected equity derivative products. “We have seen a big kink develop in the term structure of the ‘Vix’ [volatility index]. Elections have historically not triggered big one-day market movements, although the 2020 race is taking place against a backdrop of uncertainty,” said Boutle.

Is the Federal Reserve out of ammunition? What about the ECB?

On monetary policy, there are growing market concerns that the Federal Reserve has insufficient ammunition to mitigate the impact of another exogenous shock to the system. The panellists, however, argued that the Federal Reserve is not out of ammunition, although its ability to mitigate a shock fundamentally depends on the nature of the shock. Panellists said that many of the responses need to be fiscal and regulatory-driven, but added that there are actions the Federal Reserve can take without resorting to negative rates. They said it could increase the rate and breadth of its asset purchase programme. The Federal Reserve has so far avoided explicit yield curve controls, said one panellist, but that is a tool which is available in its arsenal.However, lessons for the Federal Reserve are available from Europe about what to do if another crisis strikes when rates are so low. “In our analysis, we looked at Europe to see what happens when rates are at zero or in the lower bound region. It is true that the Central Bank support for equity markets is constrained, but a positive message is that the European Central Bank (ECB)’s Corporate Sector Purchase Program (CSPP) was supportive of credit markets and helped mitigate a further widening of credit spreads. It is clear Central Banks have not run out of tools, but rather they need to change the target of their implementation tools from RFRs [risk-free rates] to credit markets,” said Michael Sneyd, head of macro quant and derivative strategy at BNP Paribas.

Considering the recent stimulus packages coming out of the United States and Europe, the panellists also explored how these affect the broader regional allocations toward equities. They agreed that some of the value in European equities stems from the sector composition across banking, energy, and autos. In addition, the speakers noted a more aggressive response recently from the ECB, such as the pooling of sovereign debt, joint issuance of bonds and a more holistic approach to fiscal stimulus. In the intermediate period, these breakthrough responses may be catalysts that have been missing from European equities for a long time, the panellists said.

Deglobalization continues

The panellists debated whether de-globalization is likely to accelerate further, a situation that may prove particularly destabilizing for sectors heavily dependent on global supply chains, including technology, manufacturing and retail. However, one panellist said it was possible a number of supply chains could move out of China – owing to the ongoing political uncertainty – and relocate in other destinations. He said Mexico could be a net beneficiary of this, especially as labour costs in the country are now more attractive than those in China. He also warned that political tensions between the US and China could widen divergences on technology standards, pointing to the recent discord over 5G.[1] The Markets360 Unplugged session was titled ‘The Power of Discount Factors: The Next Stage of the Equity Recovery.’ The panel was moderated by Greg Boutle, US Head of Equity and Derivative Strategy at BNP Paribas. Speakers included Russ Koesterich, CFA, JD, Portfolio Manager – Global Allocation at BlackRock; and Michael Sneyd, Head of Macro Quant and Derivative Strategy at BNP Paribas.

To learn more about Markets 360 Strategy and Economics from BNP Paribas, click here. BNP Paribas does not consider this content to be “Research” as defined under the MiFID II unbundling rules. If you are subject to inducement and unbundling rules, you should consider making your own assessment as to the characterisation of this content. Legal notice for marketing documents, referencing to whom this communication is directed.