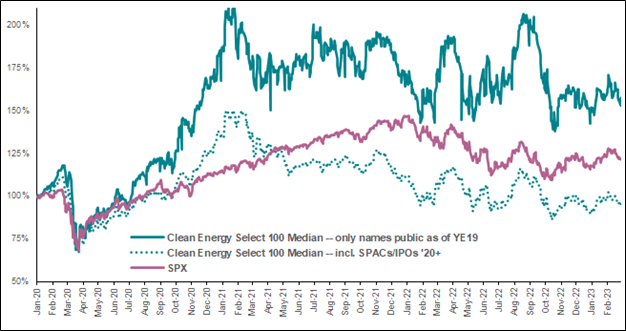

The overall sentiment on embracing decarbonization trends, that started gaining momentum in 2020, has been dampened: rising rates dragged down the US clean energy sector in 2023 following significant post-Covid gains. Against this backdrop, BNP Paribas Exane analysts are now exploring potential points of entry in the deflated space.

(Source: BNP Paribas Exane, Bloomberg)

How did we get here?

The clean energy sector has seen rapid change in the last few years. Prior to 2020, it was hard to find investors that were dedicated to clean energy. Oil and gas funds had yet to grapple with the negative WTI futures in 2020, subsequently leading investors to expand their definition of the investable energy universe. Despite a handful of market-breakout stories, renewables were still not at the forefront of the majority of investors’ minds.

However, post-Covid, the renewables sector started to gain the attention of investors. In the low-rate environment, electric vehicles, lithium and battery tech, as well as renewable power took the spotlight. Corporates across the board jumped on the renewable energy bandwagon, resulting in an explosion of clean energy IPOs and SPACs. The clean energy sector saw strengthening secular support with the Inflation Reduction Act of 2022 (IRA) and the EU energy deficit that was intensified by the sanctions brought upon by the war in Ukraine.

However, following the IRA and throughout 2023, sentiment swiftly reversed as a result of ongoing trade issues, US rate hikes and specifically the fallout from the Silicon Valley Bank collapse in March 2023. Higher borrowing costs specifically challenge the residential solar1 sector, while large scale solar2 was more impacted by trade issues in 2022.

The macro view: Clean energy sub-sectors

The challenges of the US clean energy industry are prevalent in most of its sub-sectors. Residential solar saw the greatest peak-to-trough impact. However, according to BNP Paribas Exane analysts, there is a path forward due to declining costs and rising utility bills that can offset rates. Green hydrogen shows signs of positive headline momentum, despite unclear project economics. Wind Original Equipment Manufacturers (OEMs) continue to experience estimate revisions, and face an unclear demand recovery, and yieldcos have reset to wider spreads versus benchmarks.

When looking at the clean energy sub-sectors, BNP Paribas Exane analysts consider several key principles in the investment process to navigate the macro environment. These include:

- Preference to low rates exposure with deep end market visibility

- Gaining exposure to rate-heavy holdings

- Staying clear of business models not geared toward positive KPIs

- Seeking long-term winners with near-term issues

- Taking into consideration the consensus and timing

The bright spot: US large scale solar

Despite headwinds, BNP Paribas Exane analysts see a bright spot in the US clean energy sector: large scale solar. Against the current macro backdrop, the sub-sector is in a comparatively better position than residential solar or other technologies, including wind. Large scale solar shows resilience that can withstand macro volatility, with its deep pipeline of projects and a large IRA tax credit advantage to mitigate rates risk.

Post-IRA and 2023, large scale solar has seen the greatest pace of project growth, even as rates have been rising. With the help of panel accessibility improving, the pace of pipeline growth has dramatically accelerated.

Moses Sutton Head of Clean Energy Research, BNP Paribas Exane

- Solar panels for residential use most commonly found on residential rooftops ↩︎

- Solar panels for large scale use such as electricity grids ↩︎