Attended in person by 650 of the bank’s institutional and corporate clients, the Global Markets Conference provided an opportunity for clients to gain invaluable insights into some of the main dynamics influencing geopolitics and markets today, under the theme of ‘the next normal’.

“A few years ago, we talked about the ‘new normal.’ Now, we are in the ‘next normal,’ as the world is going to change very rapidly, so we need to understand what is coming next,” said Olivier Osty, Head of Global Markets, BNP Paribas.

As the world is going to change very rapidly, we need to understand what is coming next.

Olivier Osty, Head of Global Markets, BNP Paribas

Geopolitics – the next normal

The worsening global security situation has been a recurrent theme at BNP Paribas’ Global Markets Conference over the last three years, and 2024 was no exception, with conflicts still raging across Ukraine and in the Middle East.

With a Trump 2.0 Presidency on the horizon, the stakes are now getting much higher.

Speaking at the conference, experts were divided about what a second Trump Presidency will mean for the future of Ukraine.

A leading statesperson said they are concerned that President Trump does not intend to support Ukraine either politically or militarily and doubted he would allow the country to make use of frozen Russian assets.

Another speaker however, noted that Ukraine’s already precarious position is becoming even more so but added that President Trump’s stance is more nuanced than many people may think.

European “inertia” around defence spending could face a rude awakening when President Trump takes office in January, according to some speakers. Once he returns to the White House, a US politician believed he will put the squeeze on Europe to ramp up its defence spending. “(President Trump) wants the Europeans to pay more (into NATO),” they said.

The biggest tail risk facing European security interests is whether President Trump would actually withdraw the US from NATO altogether. A statesperson conceded that while it would be very difficult for President Trump to pull the US out of NATO, he could still undermine the institution.

Tariffs

Trade tariffs are likely to be a potent feature of the Trump Presidency.

Although some people were sceptical about President Trump’s threat to impose a blanket 20% tariff on all US imports, policy experts at the Global Markets Conference believed he will be true to his word. Despite warning that the introduction of tariffs will stoke inflation and damage relations with allies, the statesperson said President Trump’s position on tariffs should be taken seriously.

A US politician concurred, adding that a number of the candidates being considered for President Trump’s cabinet – including in key Treasury positions – are supportive of tariffs.

Experts were, however, sharply at odds about how Europe should respond to the US tariff threat.

Some believed that tariffs can be avoided if the EU flexes its collective muscles in negotiations with the US, although one US politician highlighted that President Trump will want to hold bilateral, transactional dialogues with individual member states – instead of talking to the EU as a single, homogenous trading bloc.

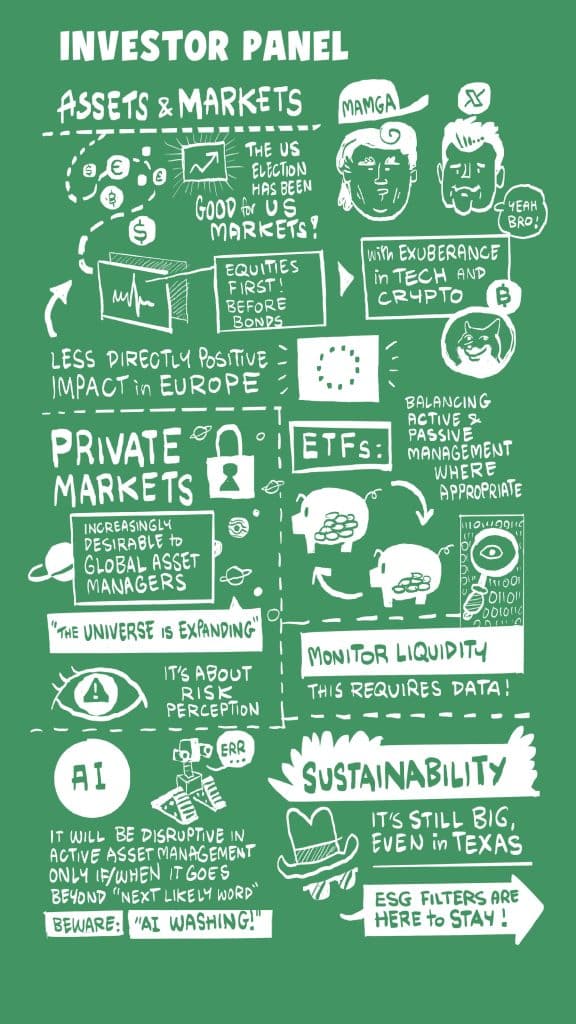

Asset management

The audience heard that the asset management industry is undergoing a transformation.

M&A in asset management circles has been fairly ubiquitous, as firms look to obtain both scalability and access to new products, such as private markets. There are several drivers behind this pivot by traditional asset managers towards private markets. With the number of public listings dwindling, some experts believed investing in private markets will be an effective way for managers to diversify their returns and supplement performance.

At the same time, speakers said that private market firms are working closely with distribution platforms to target retail investors – as they look to broaden their client base beyond institutions.

However, regulators are starting to scrutinise private markets, especially following a recent spate of private market Exchange Traded Fund (ETF) launches – a product which some believe is acutely vulnerable to potential liquidity mismatches. One asset manager said regulation of private markets will be swift should pension funds or retail investors suffer losses in a credit cycle downturn.

Artificial intelligence

A theme that emerged from discussions at the conference was the increasingly widespread adoption of Artificial Intelligence (AI) in the financial services sector. Participants underscored its potential to drive significant benefits, including the automation of back-end processes, enhanced decision-making capabilities, and accelerated data processing.

However, they cautioned that its increasing presence is not without associated risks. Potential manipulation of markets and the rapid dissemination of fake news, as well as the threat of reputational risk due to “AI-washing”, where companies make misleading claims about their use of AI were discussed.

Conclusion

The overarching takeaway from this Global Markets Conference is that the world is entering a period of rapid change, and the “next normal” will be shaped by a complex interplay of geopolitical, economic, and technological factors. As the global landscape continues to evolve, industry leaders must stay vigilant and adapt to emerging trends. The conference highlighted the need for increased cooperation and dialogue among nations, as well as between the public and private sectors, to navigate the challenges and opportunities of the “next normal”.