In June 2018, China set itself up on the global stage giving foreign investors access to a large slice of its USD 11 trillion bond and USD 7 trillion equities markets. After MSCI’s decision last year to add 222 China A Large Cap stocks to its Emerging Markets Index, global investors suddenly awoke to a new reality – Chinese A-shares would need to be part of their portfolios. This followed on from Hong Kong’s stock exchange announcing major changes to its listing rules and procedures, in a bid to gain a bigger share of the global IPO market in late December 2017. And as momentum continued to swell, Bloomberg announced that it would study the inclusion of Chinese bonds into its global indices by April 2019.

Opportunities are abound for investors looking to diversify their portfolios in Asia Pacific. Yet, with these changes come complexities given the unique characteristics of each Asia Pacific market by way of of regulations, trading infrastructure and risks.

Whilst investors are seeing a growth in opportunities, there are much wider implications for financial intermediaries in the region.

Coupled with regulatory changes, new products and technologies, Asia Pacific markets are looking to transform their clearing and settlement practices, with transformations already taking place across the region. Following Australia’s lead in using distributed ledger technology, exchanges in Hong Kong, Singapore and Japan are each considering their own approach to blockchain. At the same time, markets such as India and Malaysia are considering adopting SWIFT’s ISO 20022 messaging format, which could replace legacy systems connecting to central counterparty clearing houses (CCPs) and central securities depositories (CSDs). And at a time when local regulators are reassessing capital requirements, risk reduction is driving markets towards shorter settlement periods, which can prove especially challenging for European and US investors trading in the region unless they have a regional presence.

In a dynamic, fast-changing region, comprehensive custodial, clearing and settlement services are crucial, and unlike self-clearing, third-party clearing (TPC) provides the most benefits and flexibility, while offering significant cost savings.

Flexibility and efficiency

Asia poses a number of key differences compared to Europe and the US, with liquidity constrained given the number of different currencies used across Asia’s diverse markets. This means investors are more exposed to FX transactions than they would be in the EU or US, sometimes leading to delays and impacting intraday liquidity requirements. Similarly, brokers that operate regional hubs in Asia Pacific may need to move funds from market to market to effect the timely settlement of transactions with their clients. One solution is for brokers to seek intraday liquidity solutions from their banking partners. These solutions need to be flexible enough to cover any peak activity that comes from rebalancing periods from their clients, whilst not creating significant fixed costs that can hit profitability. The banking partner may request collateral or some other form of assurance from the broker to provide the necessary credit line and this can impact on the brokers’ overall asset structure.Brokers that operate regional hubs in Asia Pacific can work with their banking partners to settle transactions with clients in a timely manner across markets.

TPC provides an alternative solution: the clearing party could, for instance, provide intraday liquidity solutions to the broker on an uncommitted, undisclosed basis to assist in the coverage of their daily activity. Another option to add more certainty and flexibility would be to do so on a committed or overnight basis. These solutions allow brokers to feel more comfortable meeting the needs of new clients with cross-border liquidity requirements and the clearing agent can use the assurance gained from their operation of the clearing and settlement flow to reduce the additional collateral requirement.

Another key advantage for a bank or broker to outsource their clearing to a third party is that securities services providers make it their business to be at the forefront of anticipating how regulatory changes will impact their clients.

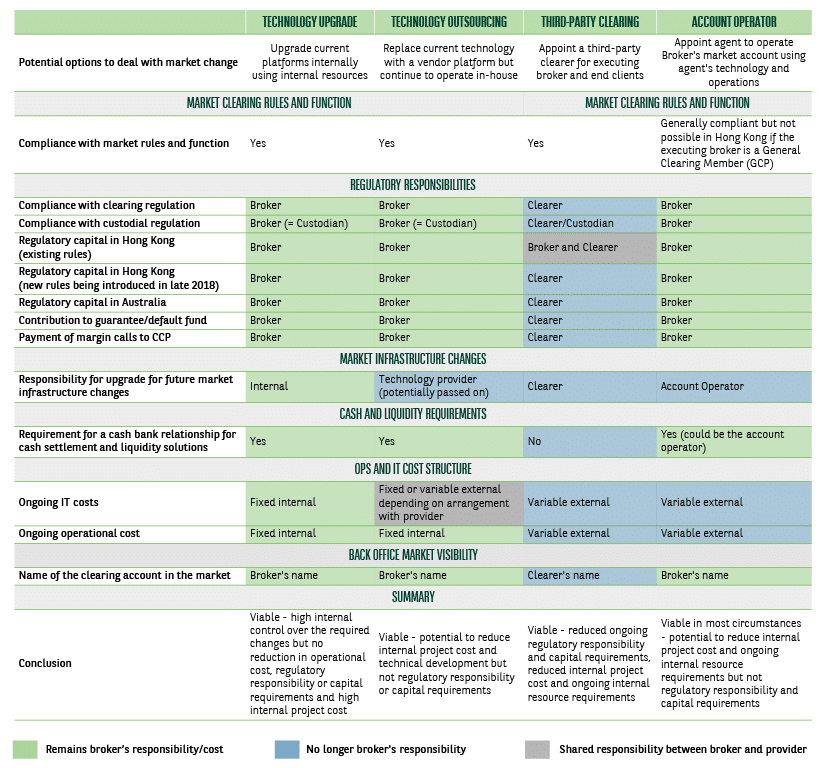

In a dynamic, fast-changing region, can the historic models of self-clearing or account operator still allow brokers to compete successfully? Or is third-party clearing a solution to help market participants adapt to new technologies, regulations and settlement standards?

Julien Kasparian, CEO of Hong Kong, BNP Paribas Securities Services

Capital requirements, payments of margin calls and contributions to the default fund are all passed to a third party outsource provider, which also assumes responsibility of preparing for future changes to market infrastructure. TPC does away with the need to maintain a separate relationship with a local bank for cash settlements and liquidity requirements. Even large international brokers, who might typically opt for self-clearing to handle high trading volumes, would be best served by outsourcing to a TPC partner, which can lead to lower and more manageable variable costs and avoids the international broker needing to keep a very close eye on the ongoing changes in each local market.

Access to Technology

A TPC operator can also provide clients access to its technological expertise, which can be especially useful in managing changes to market infrastructure. As the implementation of new technology like blockchain and the introduction of new messaging standards hastens across markets, adapting to the digitisation of post-trade systems can pose a challenge for smaller brokers, bringing higher costs and the need to re-evaluate current operating models.BNP Paribas Securities Services owns a stake in US-based fintech company, Digital Asset, which has helped ensure that the custodian is ready and anticipating developments in technology. Digital Asset is developing a clearing and settlement system, potentially the first industrial-scale platform using distributed ledger technology, to replace the Australian Securities Exchange’s Clearing House Electronic Sub-register System, or CHESS.

International and local expertise

A TPC partner combines the services of custodian, settlement agent, netting provider, liquidity provider, and settlement and cash bank, not to mention a technology provider with guaranteed operational support. TPC gives brokers the confidence that a committed, focused partner is helping them meet their regulatory and client needs.An expert such as BNP Paribas Securities Services, one of the largest third-party clearers in the region, can bring a consultative approach and dedicated teams of local experts to help manage new regulatory environments and minimise their impact. As the region moves to implement wide-ranging changes to its market infrastructure, many of which are expected to be along the lines of those in practice in European markets, BNP Paribas Securities Services is well positioned to assist investors to make the most of the immense opportunities offered by the Asia Pacific markets.