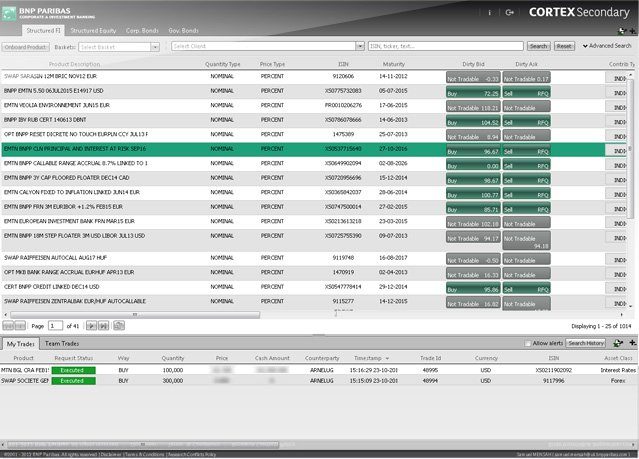

BNP Paribas’ secondary market trading platform

Combining intuitive technology and access to BNP Paribas liquidity, Cortex Secondary gives you the flexibility to securely click and trade real-time secondary market prices across interest rates, credit, inflation, foreign exchange, and hybrid structures together with thousands of corporate and government bonds.

Cortex Secondary provides efficient execution and transparent pricing across an extensive range of fixed income cross asset cash and derivative financial products

Explore the unique features of Cortex Secondary

Dynamic interface design

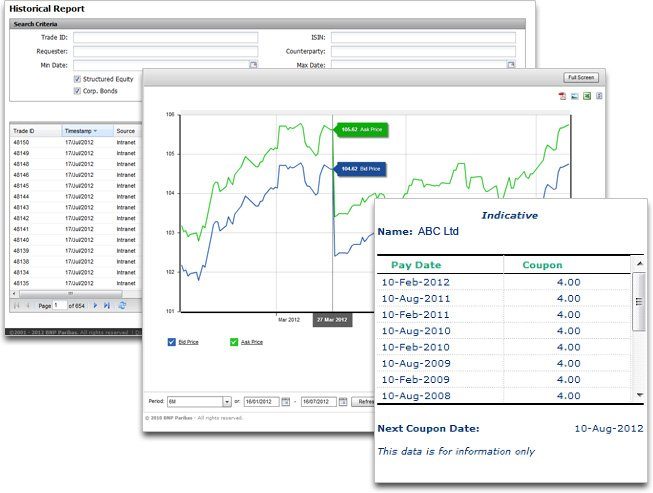

Cortex Secondary employs a comprehensive search filter that enables you to view the full inventory of instruments available on the platform (searches can be customised by ISIN, maturity, strategy or current). Once a product has been selected, Cortex Secondary allows you to create your own unique customised trading interface with only the products you need.

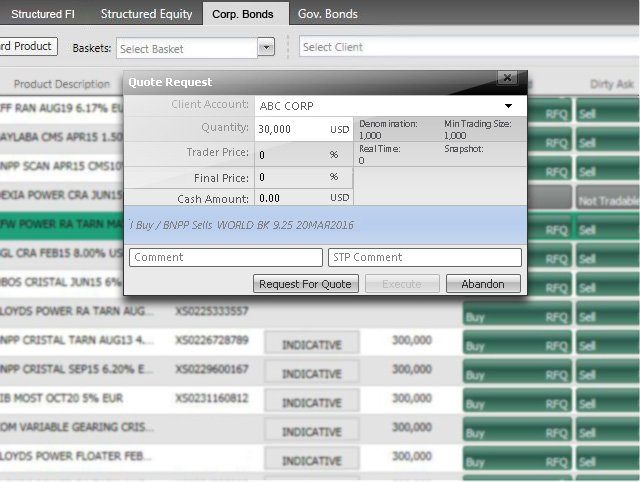

Corporate & government bonds

Access real-time executable secondary market prices across 16,000+ supported cash fixed income products.

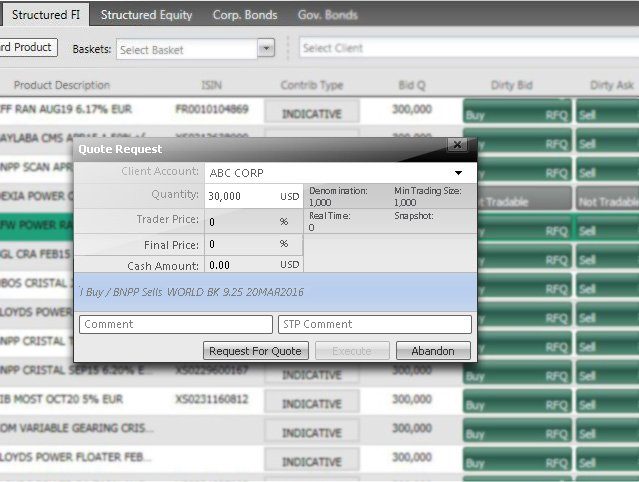

Structured fixed income products

Access real-time executable secondary market prices across 700+ supported structured fixed income products.

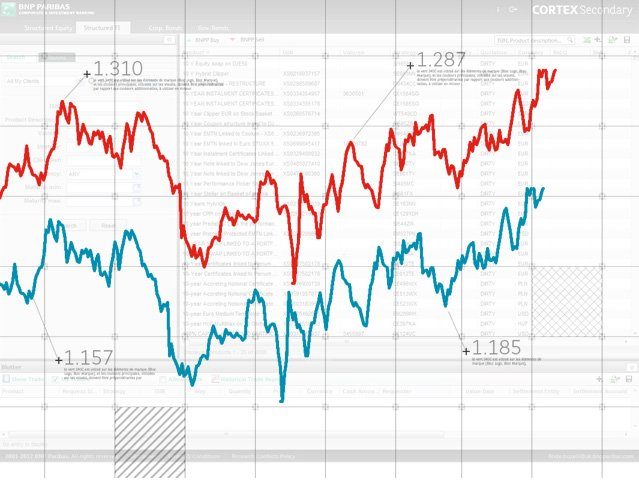

Competitive pricing

Our competitive and consistent pricing has been configured to perform and provide efficient execution in different market conditions.

Reporting and evaluation tools

Reporting and evaluation tools enable you to view all your trading activity from fully customisable trader blotters. Alternatively, the platform can also create market snapshots by exporting historical price charts, coupon history and termsheets to excel.

Be the first to know

Every month, be the first to know about our latest publications

Awards

Events

Insights