As markets have entered a more volatile period, two experts at BNP Paribas Global Markets; Renaud Meary, head of equity derivatives, and Olivier Renart, head of trading – global equities, discuss how client demand is affected and how, as a bank, they are manoeuvring to respond to these needs.

How has the recent macro environment impacted the market and client demand?

Olivier: We are noticing a trend of clients currently underinvesting in risky assets as they are showing caution towards equity products. With inflation picking up, central banks are tightening monetary policy in the western world, which increases rates across Europe and the US. This context is putting pressure on all risky assets (bonds and stocks), which puts Europe, especially with the situation in Ukraine, in a very sensitive position, even more so as economists are predicting a recession. In Asia, which is largely dominated by China, we see the effects of their zero Covid policy reverberating through their local economy and the global markets.

It seems that we are exiting a 10-year period of quantitative easing with ultra-low rates and low central bank support, and entering a period of higher inflation, higher rates, and higher volatility. This very large paradigm shift is affecting all client types on a macro and micro basis, from geopolitical tensions to companies’ balance sheets, the impact of this new normal is becoming more acute. There will be sectorial winners and losers but mostly lower margins with reduced demand because of affordability.

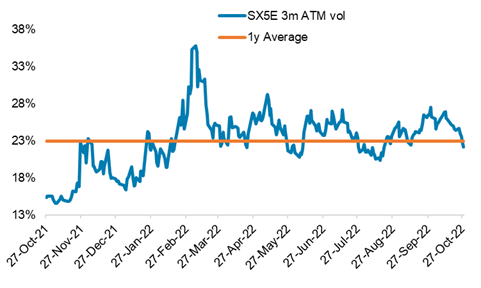

High volatility: SX5E 3m ATM vol

Renaud: In this context, investors are looking for lower-risk opportunities and idiosyncratic aspects of single stocks become far more relevant for generating return alpha for clients. With such high uncertainty, institutional investors need flexibility and products like options that enable both hedging or directional positioning with limited loss. As far as individual investors are concerned, interest rates being back on the rise brings capital protection back in favour. The macro environment is also more conducive to single stock volatility and shorter term, tactical themes; these are the high-level elements that make single stock or sector specific option trading more important to clients at the moment. Investors are definitely showing caution especially with recent unforeseen events such as the UK pension stress, and unpredictable elements such as the ongoing Ukraine conflict.

How did BNP Paribas adapt its strategy to fit this new context?

Renaud: In line with the Bank’s 2025 strategic plan for growth, BNP Paribas has worked to build great ambitions regarding its newly created Global Equities business line, which houses equity derivatives, prime services, and cash equities. This combined business line brings together the best in class of each metiers: BNP Paribas’ historic leadership in equity derivatives (especially in structured products), the highly recognised Exane brand in cash equity, and the best of breed ex Deutsche Bank Prime brokerage platform.

We have improved our models and implemented a different macro hedging strategy, which positively impacts the trading side of the business. For years, the bank’s equity derivatives franchise mostly relied on two main pillars: structured products and Delta 1 parameters – dividend, repo etc. Over the last 2 years we reviewed our business model and shifted our strategy with a heavier balance on the flow side of the business, while de-risking the distribution side of its offering through risk management and risk recycling actions, and through a diversification of our offer in that space. In order to foster this new ambition on the flow side, we have invested in capabilities and talent including a number of high-profile hires to boost our flow-trading set-up.

Olivier: The integration of Prime services and the Exane cash equity business completed the gap for building the bank’s flow and corporate derivatives businesses. This supports our ambition to become the leading European house in equity derivatives by 2025.

How is BNP Paribas developing credible single stock trading capabilities?

Renaud: Historically, BNP Paribas’ strong suit has been exotic products, volatility and trading the derivatives parameters. With the addition of Exane and prime brokerage to our equities business, we are in the process of aligning our organisation with focused desks on single stock offering, volatility trading but also on the fundamentals of companies with directional views; these can also expressed through options. Our new set up aligns cash equities, prime brokerage and option market-making which enable us to cover the full picture.

Olivier: The bank is investing a lot in this segment as we have a team composed 100% of new hires, who have that trading DNA combined with experience from a range of industry experience. The idea behind this new model is to be able to provide liquidity but also advisory services to our clients. Exane being a leading house for equity research, we can now provide clients with the full service: content, trade ideas and execution.

With the competition increasing on the derivatives market with tight margins on client trades, BNP Paribas’ is refocusing on clients that approach option trading from a fundamental/directional perspective (rather than a technical volatility arbitrage strategy). We are well on the way to creating a consistent and coherent flow platform, which includes index, single stock, conversion, convertible bonds, and corporate activity. Our Global Equities set up enables us to service a new breadth of clients, such as long-short hedge funds.