The increase in bond issuance from real estate issuers has underlined a strong hike in debt markets across the UK and Europe in recent years, generating an upsurge in interest for the asset class. The trend has continued this year with real estate issuers experiencing an extremely busy start to the year. This is driven by the relative overall lower interest rate environment, as a number of new joiners continue to enter the market and pound bond sales reached an all-time high in January.

As companies look to benefit from the overall low-yield environment, there has been a large incentive to raise capital, driven mainly by the search for disintermediation, but also M&A activity from listed Real Estate Investment Trusts (REITs). Disintermediation has been spurred by real estate companies’ growth by way of investments and increased assets valuations. This has offered room for debt increases and Investment Grade ratings, combined with a higher available market liquidity, which is strengthened by the ECB and investors’ appetite for diversification. The latter has recently led to the emergence of new sub asset-classes such as logistics, tied to the boom in e-commerce seen during the Covid-19 health crisis.

Why the sudden funding spree?

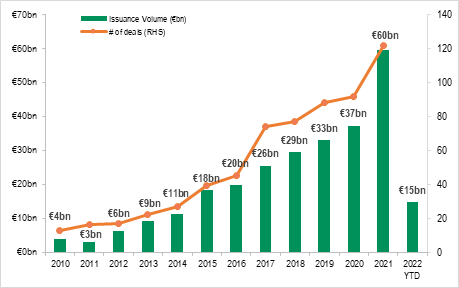

Since 2011, the Euro property bond market has seen substantial growth deriving predominantly from European issuers, who represent the largest portion of the market. While in past years the bulk of issuances came primarily from France, followed by Spain and Germany, we have observed a significant increase in volumes coming from the Nordics as well as the UK. More recently, the diversity of issuer type has also evolved, with funds now entering the bond market. In the last year alone, real estate issuance has increased by more than 60% in terms of volumes, and more than doubled its market share.

Real estate issuance history by volume

Real estate companies have historically financed themselves through secured debt. However, with the European Central Bank (ECB) bringing liquidity to the market, REIT issuers have increasingly looked for disintermediation and progressively moved from secured to unsecured debt for their funding needs.

Given that the cost of funding is a major component against existing business models within the industry, real estate clients have always proven very agile when refinancing their debt by anticipating their needs while locking attractive rates and lengthening their debt duration. Unsecured bond debt is also a key tool for companies looking to grow.

Samar Azmi, Director – Corporates Debt Capital Markets, BNP Paribas

Under the ECB’s Corporate Sector Purchase Programme (CSPP), non-financial corporations with an Investment Grade rating have benefitted from improved access to the bond market, both in terms of cost and liquidity. Simultaneously, this additional liquidity bucket has helped open the market to competition and new entrants, and even smaller and non-ECB eligible ones such as funds. Moving away from the mortgage and loan market, existing and new market participants can make use of the bond market as an alternative source of funding, offering them better growth prospects.

At the same time, investors looking for diversification find the real estate asset class to offer a variety of sub sectors such as offices, residential, retails, logistics and more. The Retail sector in particular, despite being hit by the Covid-19 health crisis, has managed to raise funds underlining investors’ support for the asset class.

What are REITs?

REITS are regulated companies, modelled after mutual funds, but for the real estate market. REITS are highly liquid given that they are traded publicly on securities exchanges, offering individual investors the opportunity to invest in income-producing real estate without the necessity for a large capital outlay to purchase the physical property.

The real estate market has demonstrated growing appetite for the unsecured bond market. Logistics and residential issuers have been the most active, but other sub segments that suffered over the last two years from discounts in the equity market (such as office and retail REIT) have found strong appetite from bond investors at attractive conditions.

Pierre Semeria, Head of Real Estate Capital Markets, BNP Paribas

Important players in the green bond market

As investment volumes rebound strongly, the real estate sector plays a crucial role in driving best practice to further the goals of the Paris Agreement and shape the narrative around addressing climate, environmental and social challenges in the market. Asset owners are natural green bond issuers thanks to their high amount of eligible assets available. Several major European real estate owners have already switched their entire debt portfolio to green.

As the market continues to mature, green bonds are on track to become a new financing standard for many in the market.

Leading the way in the real estate market: recent milestones

Heimstaden Bostad Treasury:

- On Monday 17th January, Heimstaden Bostad successfully priced a €1.2bn dual-tranche bond across Long 3yr and Long 6yr tenors via its Dutch subsidiary, Heimstaden Bostad Treasury B.V. The transaction delivered coupons of 0.625% on the 3.5yr and 1.375% on the 6.5yr.

- The proceeds of the new issue will be used to finance Heimstaden’s remaining outstanding commitments under the Bridge put in place for the acquisition of Akelius’ German, Swedish and Danish property portfolios

- BNP Paribas acted as Joint Bookrunner

P3 Group:

- On Wednesday 19th January, P3 Group – the third largest rated logistics property company in continental Europe – successfully printed €1bn of EUR-denominated Green Senior Unsecured notes across two tranches. The dual-tranche 4yr/7yr transaction is P3’s debut EUR public bond issuance and is in Green format. The transaction priced at MS+100bps on the 4yr and MS+150bps on the 7yr with coupons of 0.875% and 1.625%, respectively

- The net proceeds will be used in accordance with P3 Group’s newly established Green Finance Framework to finance Eligible Projects, primarily Green buildings

- BNP Paribas acted as Joint ESG Structuring Agent and Joint Active Bookrunner

Axa Logistics:

- In November 2021, AXA Logistics Europe Master, an open-ended real estate fund specialised in Logistics, issued an inaugural €800m Green dual-tranche bond with attractive coupons of 0.375% for the €500m 5y transaction and of 0.875% for the €300m 8-yr tranche

- The Use of Proceeds will be allocated to Eligible Green Projects as defined in t Green Financing Framework published by the Fund in October 2021, primarily Green buildings.

- BNP Paribas acted as Joint Active Bookrunner