Q2 views maintained

For Q3 2021, the Markets 360 team maintains its views after the following themes expressed in Q2 played out:

- Europe catching up with the US;

- The reflation story having legs;

- Developed-market central banks retaining an asymmetric reaction function; and

- Emerging-market monetary policy reaching a turning point.

In general, Markets 360 experts continue to expect above-consensus growth and inflation, with the risks still skewed to the upside. The exceptions are Japan and China, where BNP Paribas economists and strategists revise down their 2021 GDP growth forecasts due to a slower vaccine rollout and sluggish consumption, respectively.

Tapering, but no tantrum:

The strong policy mix is a key factor in Markets 360’s view, as the strategy and economics division expects fiscal and monetary policy accommodation to persist for longer than in a typical cycle.

While developed-market central banks are deliberately behind the curve, Markets 360 believes that they will have to react to the improved economic outlook, albeit gradually and with real rates staying low, avoiding a ‘taper tantrum’.

In emerging markets, some central banks have started hiking rates: Markets 360 expect many others to follow suit.

As for the Federal Reserve, the experts expect its tapering to start in early 2022, with related talks starting at the September 2021 meeting and the first rate hike in Q1 2023.

What is a ‘taper tantrum’?

– Taper tantrum refers to the 2013 collective reactionary response that triggered a spike in U.S. Treasury yields, after investors learnt that the Federal Reserve was slowly putting the brakes on its quantitative easing (QE) programme

– The ‘tantrum’ stemmed from fears that the markets would crumble as QE ended

– Ultimately, these fears were unfounded, and the market levelled out after the tapering programme began

Policy is key. We do expect tapering, but no tantrum. Why? Because:

Olivia Frieser, Global Head of Markets 360

1. Central banks will proceed gradually and tapering has been well telegraphed

2. Real rates will remain low

3. Market positioning is not excessive.

BNP Paribas

Optimistic on assets globally

US and Europe: Markets 360 experts expect higher nominal and real yields in the US and Europe at the end of Q3. They also expect the curve to steepen moderately in Europe but flatten in the US. They are positive on risky assets, expecting equities to be able to cope with higher yields. Low credit vulnerability means ‘carry is king’ in this asset class.

Emerging markets: The strategists and economists are optimistic overall, especially if commodity prices remain stable, but they believe the importance of differentiation and idiosyncratic stories will rise.

Focus on oil: Markets 360 experts expect oil prices to rise in the short term – supported by reflationary fiscal and monetary policy and the continued production restraint from the Organisation of the Petroleum Exporting Countries (OPEC) – before fading in 2022.

Sustainability focuses on emissions disclosure

As the COP26 climate change conference approaches, Markets 360’s experts expect the G7 nations to require companies to disclose their scope 1 and 2 (direct and indirect) greenhouse gas emissions from 2022. To try to monitor the transition to net zero, the G7 agreed in June to make it compulsory for publicly listed companies to comply with the taskforce on climate-related financial disclosures (TCFD).

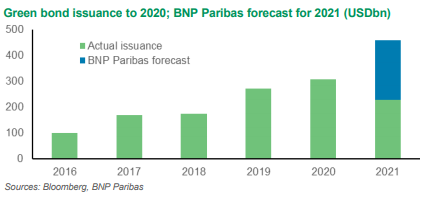

Markets 360 sustainability analysts expect green bond issuance to grow to between USD430bn and USD460bn this year – a 50% increase year-on-year – driven by European net-zero goals and companies looking to stay ahead of regulation and rising carbon costs. Even with this increase in green bond issuance, the analysts think the greenium – the premium on green bond prices – will remain stable.

BNP Paribas does not consider this content to be “Research” as defined under the MiFID II unbundling rules. If you are subject to inducement and unbundling rules, you should consider making your own assessment as to the characterisation of this content. Legal notice for marketing documents, referencing to whom this communication is directed.