While the trajectory is likely to be somewhat bumpier than outlined in our Q3 Global Outlook forecast, we stick to our fundamental story of a solid and enduring policy-led recovery. We also maintain our long-held view that higher inflation expectations will transform what is an inherently temporary price shock into a more enduring reflationary trend.

Olivia Frieser, Global Head of Markets 360, BNP Paribas

The Markets 360 team view the global outlook for the rest of the year as a marathon, not a sprint. This broadly means that, while the growth outlook is positive, the recovery will take longer than initially anticipated. The central themes to this position are:

Supply-side bottlenecks

In earlier waves of the pandemic, the effect of lockdowns on demand prevailed over the drag of supply. Now, the recent resurgence of Covid-19 cases appears to be affecting supply to a larger extent than demand. Exacerbated and prolonged supply chain disruption, as well as other friction such as mismatches between labour demand and supply, are weighing on output growth while putting upward pressure on inflation.

A challenge for central banks

Against this more challenging backdrop, central banks globally are likely to react differently. Emerging-market central banks are likely to continue tightening policy to respond to rising inflation; in many the tightening process is already in full swing.

For most central banks in the developed markets, after a long period of low inflation the continuing near-term focus is likely to prioritise growth rather tackling inflation. The Markets 360 team expect the Federal Reserve to announce tapering in December, paving the way to a rates lift-off as early as end-2022, while the first rate hike from the ECB is only likely to come in 2024.

In the UK, unlike the Fed and the ECB, the Bank of England has not changed its strategy nor experienced a significant undershoot of its inflation target. Markets 360 experts think it will be the first bank to tighten policy. It is also the only central bank contemplating reducing its balance sheet actively (through bond sales as well as re-investment), though this is unlikely to materialise within this forecast period.

Living with Covid-19

Even as the global recovery from Covid-19 is underway, the underlying assumption of a world after Covid-19 has shifted to a world with Covid-19. As ‘herd immunity’ looks increasingly unattainable, it’s becoming clear that economies will have to adapt to live with the virus.

Although the impact of Covid-19 on economic activity is likely to moderate in Q4 2021 and into 2022, some pandemic-related impact in other areas could linger – for example reshoring, de-globalisation, some shifts in consumption habits (e.g. towards online shopping) and a greater role of the state in the economy.

Still positive for markets

In spite of the challenges, the Markets 360 team remain positive on markets, but see the need to differentiate after this year’s gains. Trade ideas have shifted accordingly, from passive beta investment to selective alpha market positioning.

The team expect higher US and EUR nominal and real yields by the end of Q4, with the yield curve on 10y UST flattening as the Fed tapers. In the eurozone, they expect a rise in inflation breakevens to drive a moderate steepening of the curve.

They are broadly neutral on US equities and see more upside on European stocks, given the risk of higher taxes and interest rates. Credit is likely to generate low but stable returns without much volatility due to fundamental and supply risk, as well as low outflow risk.

In the oil markets, despite the Covid-19 related setbacks to oil demand, the supportive economic growth outlook remains a key support for higher prices in the short term, the team think.

Updated climate change commitments

The COP26 climate change convention in November will mark an important milestone in spurring nations to pledge new or more ambitious climate policies and targets, particularly around climate-related disclosures. Markets 360 experts also remain optimistic that developing nations will receive long-awaited funding to help them transition to a low-carbon economy and mitigate the impact of climate change.

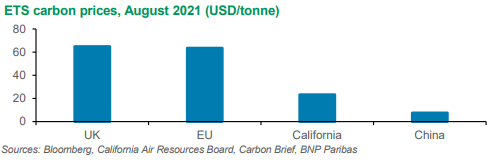

However, it looks unlikely that a consensus will be reached on global carbon pricing, owing to the wide disparities in the price of carbon (see chart). The team believe COP26 will acknowledge the need for a global carbon price but agree to proceed at the country level for now, to avoid a single carbon price that could burden EM economies unduly.

BNP Paribas does not consider this content to be “Research” as defined under the MiFID II unbundling rules. If you are subject to inducement and unbundling rules, you should consider making your own assessment as to the characterisation of this content. Legal notice for marketing documents, referencing to whom this communication is directed.