KEY TAKEAWAYS

- Systematic credit has evolved as a strategy in recent times and is now gaining traction with allocators.

- Over half of respondents in our survey either already invest or are considering investing in systematic credit.

- 28% of respondents are looking to increase their investment in the next 12 months.

- Intermediaries (specifically Fund of Funds and Investment Consultants) are the key players currently investing in the space. Institutional investors are also showing increasing appetite in systematic credit.

- Availability and quality of data as well as execution capabilities were highlighted as the main challenges to investing in systematic credit.

In September, the BNP Paribas Capital Introduction team invited its global investor community to participate in a flash survey on investing in systematic credit strategies. We collected responses from 47 allocators who invest in or advise on hedge fund assets totalling $247 billion (median: $1.3 billion). Over half of the respondents are based in the Americas (53%) with the rest mainly in Europe (40%) and a small number from Asia Pacific (6%).

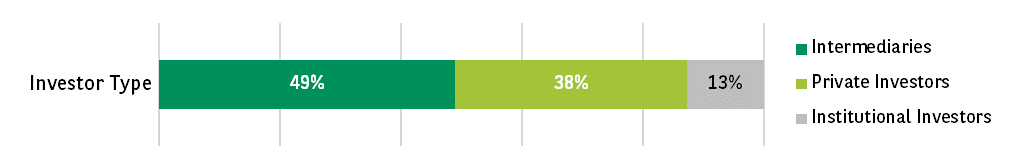

By investor type, respondents varied across Intermediaries (49%, including Fund of Funds, Investment Consultants and Outsourced CIOs), Private Investors (38%, including Private Banks, Wealth Managers and Family Offices), and Institutional Investors (13%, including Pension Funds, Foundations and Trust Banks).

Evolution of Systematic Credit

By definition, systematic trading aims to be as machine-like as possible. Not only does it involve technical analysis, simulation and the backtesting of strategies, it also looks to automate the trading process. When applied to the credit space, systematic credit trading may be understood through three steps:

- Data: structured and unstructured data is acquired and/or purchased by fund managers. Unstructured data is then structured by the fund manager.

- Algorithmic models: once all the data is structured, fund managers use the various data sets to build and test algorithmic models. The models that demonstrate strong alpha signals are then tested for execution to ensure that the method (electronic, voice), speed and cost of execution (commission and borrow) still results in the model delivering a desired expected return.

- Execution and risk management: these algorithmic models are executed in the market. This is where the industry has room for improvement as the automation of executing these strategies is limited by type of credit instrument, liquidity and size.

We can therefore understand why systematic trading has historically been the domain of exchange-traded securities such as cash equities and listed futures and options. These markets with deep liquidity, high quality data and advanced electronic trading infrastructure, are fertile ground for systematic models. However, credit instruments are traded over-the-counter (OTC) and the lack of long-term quality data and transparency has made it difficult to build systematic models trading credit.

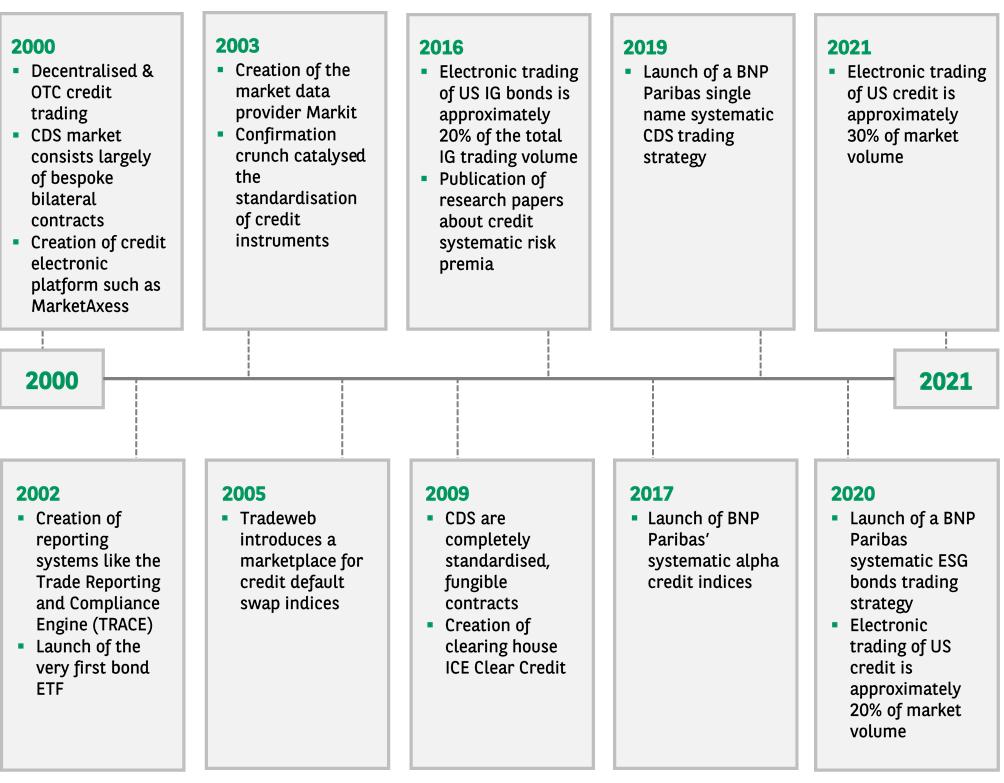

Before 2002, credit trading was conducted exclusively in decentralised, OTC markets where investors negotiated directly with broker-dealers over the phone. In 2002, the credit space started to transform with the creation of the Trade Reporting and Compliance Engine (TRACE) in the US that facilitated the mandatory reporting of OTC transactions in eligible fixed income securities. In the same year, the first bond Exchange Traded Fund (ETF) also launched.

In 2009, credit default swaps (CDS) became standardised and fungible due to the development of CDS clearing houses and a more regulated market. By 2010, we saw the proliferation of electronic bond trading platforms and market data providers such as MarketAxess, Markit and ICE. This helped to build data and the electronic trading infrastructure which allowed the systematic trading of credit instruments.

2016 saw the publication of research papers on systematic credit premia during which time the electronic trading of US investment grade bonds grew to 20% of the total US Investment Grade (IG) trading volume.

In the first three quarters of 2020, the credit trading volume from systematic funds on the MarketAxess platform reached $116.5bn, up over 150% from the same period in 2019. In 2021, estimates from Greenwich Associates showed that electronic trading in US credit is now approximately 30% of the total market volume, up from 20% a year ago. We can attribute this new flow of quantitative credit trading to two factors:

- The increased availability of high quality data

- Growth of liquidity providers enabling systematic credit strategies to have a higher likelihood of execution when signals are received

The evolution of technology and data is therefore to some extent consistent with the development of the systematic credit strategy, insofar as it is responsible for it. If there is room for growth with the former, is it reasonable to expect the same for the latter?

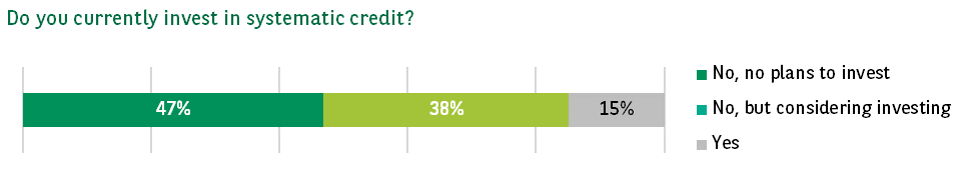

All survey respondents were asked whether they currently invest in systematic credit. Fifteen percent of respondents currently invest in this strategy, with a further 38% considering investing.

When looking at investor types, Intermediaries (specifically Fund of Funds and Investment Consultants) are the key players currently investing in the space. Institutional investors are also showing increasing appetite with the large majority considering investing in systematic credit. Private Investors showed the least appetite for the strategy as a group.

In order to further understand how respondents are investing in the strategy, we asked investors whether their exposure to systematic credit is accessed through a multi-strategy fund or a dedicated systematic credit fund. Of those currently invested, gaining exposure through the former is marginally more popular than the latter.

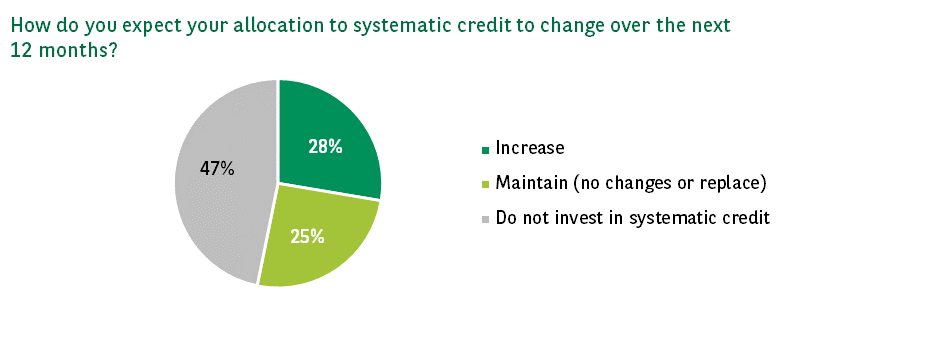

When looking to the future, 28% of all investor respondents are looking to increase their allocation to systematic credit in the next 12 months. Sixty-two percent of those considering to invest are looking to do so through dedicated systematic credit funds whilst 46% of respondents are looking at systematic credit exposure through a multi-strategy. The increased appetite of respondents to invest standalone demonstrates the growing attractiveness of the strategy.

Almost 40% of investor respondents that are considering investing into systematic credit do not expect to invest in the next 12 months, with over half of these investors sighting lack of industry track record as the primary driver.

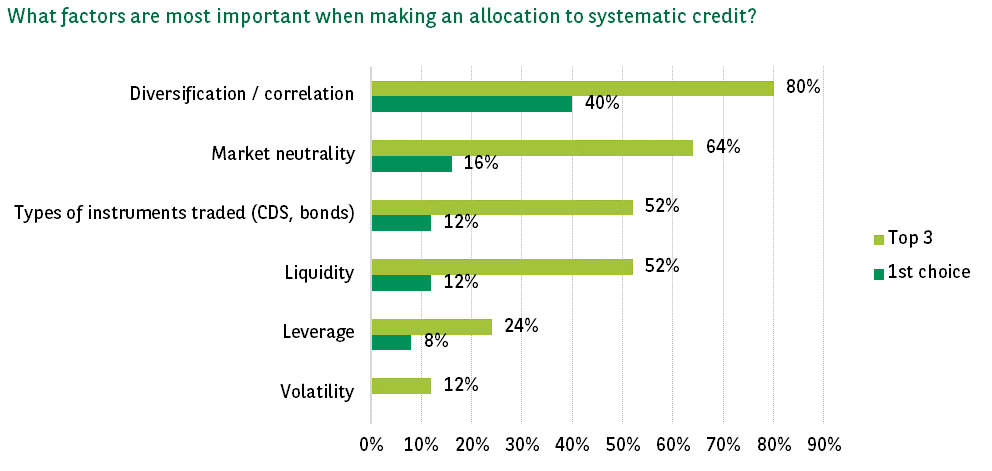

When asked for the most important considerations regarding the allocation of systematic credit, investor respondents identified diversification and correlation to be the most critical, with 40% of respondents placing it as their first choice and 80% putting it in the top three.

Other key considerations to allocation were market neutrality, types of instruments traded and liquidity; each of which were placed in the top three by over half of respondents. Volatility was the least important factor for the investor respondents that invest in systematic credit or are considering it, with only 12% of respondents placing it in their top three and none putting it as their top choice. Other factors cited by investors as most important when making an allocation were the quality of the Management Company and evidence of consistent alpha generation.

Next we asked investors what they look for when assessing a manager’s chances of success in the strategy. Manager experience was named as the key influence with over two-thirds of respondents ranking it in the first place and a further 20% positioning it in the second.

Breadth of signals and firm resources were thought to be equally important after manager experience. Sixty-eight percent of investor respondents cited the size of assets under management as the least important factor when assessing a manager’s chances of success in the strategy.

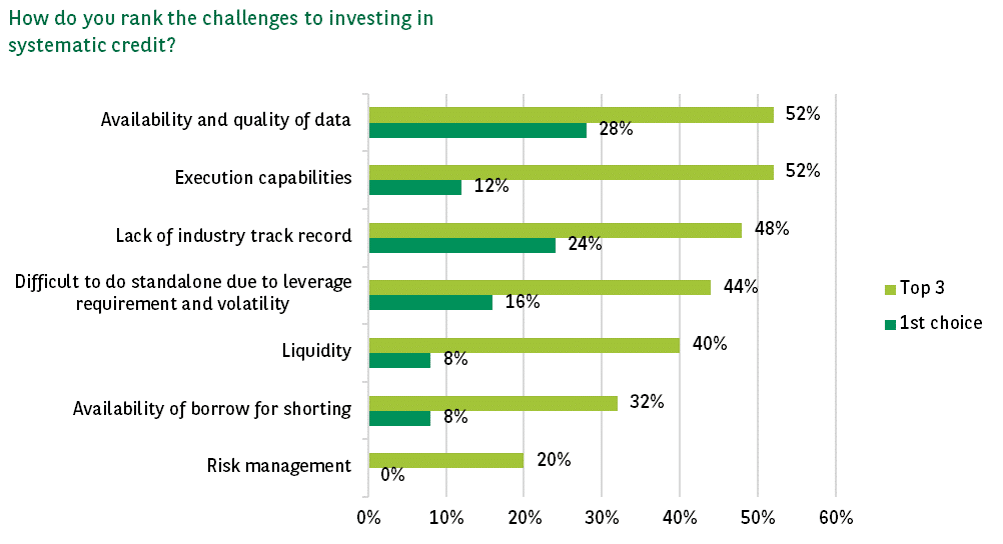

The development of the systematic credit strategy is not without its challenges. Over half of the respondents ranked the availability and quality of data as a top three most notable challenge to investing, with 28% placing it as the first place. Execution capabilities was also selected as the top three challenges by more than half of respondents.

Lack of industry track record and the difficulty in running standalone due to leverage and the volatility of the strategy were similarly ranked highly by respondents, with 48% and 44% of respondents placing them in their top three respectively. Risk management was not widely recognised by investor respondents as a key challenge to investing in systematic credit – only a fifth of respondents placed it in their top three and none ranked it as the first place.

BNP Paribas has set up a best-in-class credit prime platform to support clients leveraging the growth of systematic credit. We have integrated repo into prime to enhance our borrowing and financing services which will address some challenges highlighted by investors in this survey. This, coupled with our market-leading high touch and systematic credit execution, enable us to service systematic credit funds in an efficient and competitive manner.

Ashley Wilson, Global Head of Prime Services, BNP Paribas

BNP Paribas has developed a Credit Prime platform housed within our wider Prime Services offering with a comprehensive offer across all credit asset classes and client strategies (including systematic credit). BNP Paribas’ Credit Prime provides clients access to:

- Unrivalled borrow: Leverage BNP Paribas’ leading credit repo trading franchise, to offer clients extensive access, depth and stability of borrow at competitive rates. Digital Axe list and bot tools to check availability.

- Capital efficient cross-product margining: Systematic cross margining framework based on credit delta taking a holistic view across credit products and strategies to optimise client margin.

- Market leader in high touch and systematic execution and financing: Access cash execution from leading credit primary and secondary platform across CDS, cash and Algorithmic Credit Trading.

- Extensive collateral universe: Access competitive financing levels across a wide spectrum of credit assets globally; including governments, investment grade and high yield corporate and financial issuers, emerging market (incl. local currency), securitised product and leveraged loans globally.

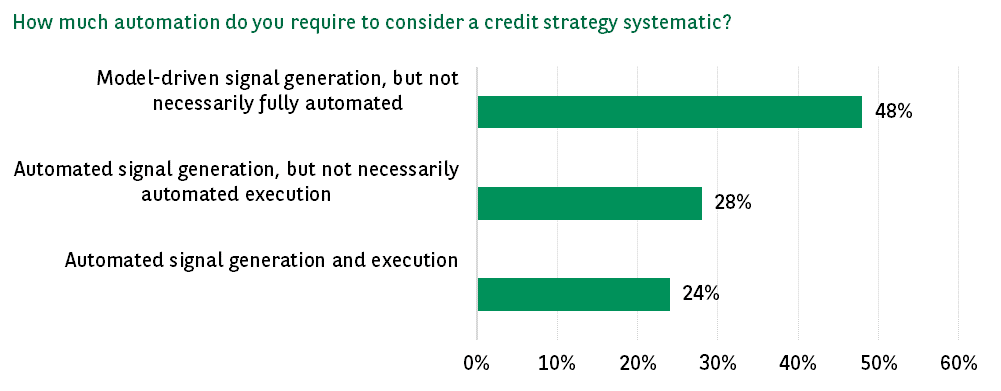

Given the ongoing evolution of systematic credit as a strategy in the industry, we asked investors how much automation they required for a credit strategy to be considered systematic. Almost half of respondents cited model-driven signal generation as the requirement. On the other hand, almost a quarter of respondents look for fully automated signal generation in addition to automated execution in order to classify a credit strategy as systematic.

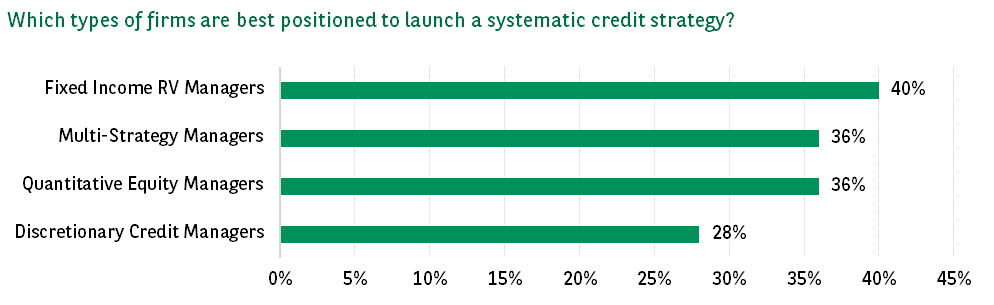

Last but not least, we asked investors which types of firms are best positioned to launch a systematic credit strategy. Fixed income relative value, multi-strategy and quant managers were regarded as the best positioned versus those managing discretionary credit strategies.

As investors seek differentiated sources of alpha in their portfolios, systematic credit becomes a key strategy to consider, as we see from over half of our survey participants. Unlike equity, credit is still dominated by buy and hold, discretionary managers and as a result, it presents many short to medium term inefficiencies that systematic managers can capitalise.

Marlin Naidoo, Global Head of Capital Introduction, BNP Paribas

Authors:

Christine Stockmeier

Quentin Domingues

Cassia Roberts

Email: capital.introduction@bnpparibas.com