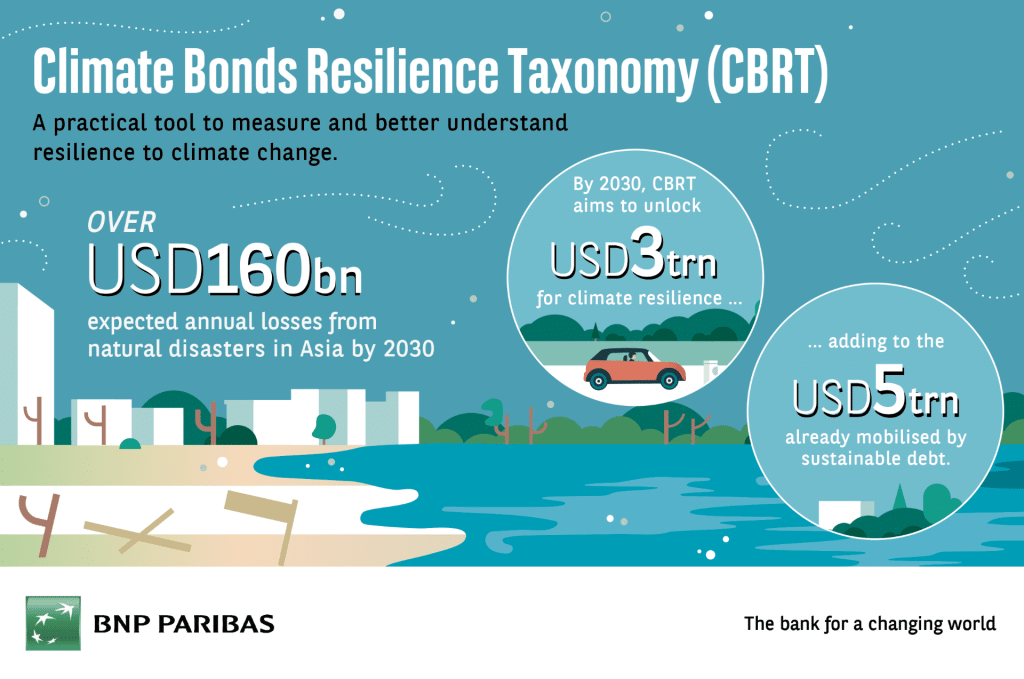

Building climate resilience is crucial to make sustainable finance decision and in the face of escalating climate change impacts. A new taxonomy measuring climate resilience could unlock up to USD 3 trillion in investments by 2030, guiding sustainable finance decisions and helping to bridge the USD 194-366 billion climate finance gap.

The growing need for climate resilience

The effects of climate change are already keenly felt across Asia. The growing number of extreme weather events – such as typhoons and heavy rainfall that leads to flooding – can result in the loss of life, damaged infrastructure, and impeded economic growth.

In 2023, the United Nations said that Asia was “the world’s most disaster-effected region… due to weather, climate and water-related hazards”. And with serious typhoons like Yagi ripping across the region, as well as severe flooding in southern China, 2024 is shaping up to be another year of intense climate activity.

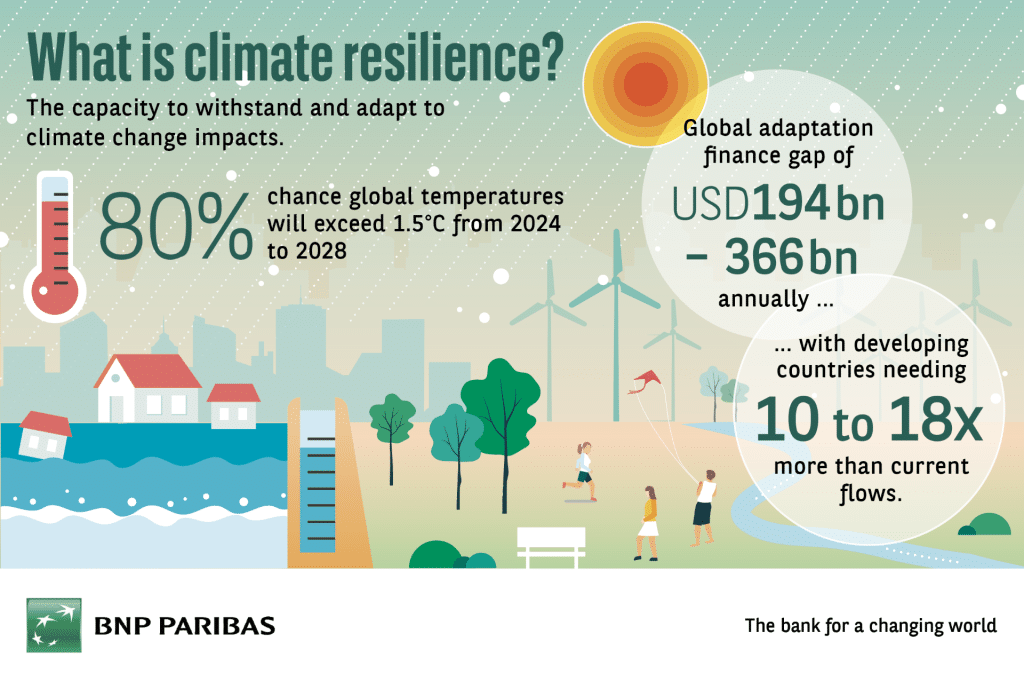

The bad news is that climate change looks likely to worsen as temperatures rise. The World Meteorological Organisation forecasts an 80% likelihood that global temperatures will exceed 1.5°C above industrial levels, sometime between 2024 and 2028. This not only highlights a need to strengthen commitments to reduce carbon emissions, but also for societies to build resilience, by adapting to further climate shocks.

The concept of resilience is especially important, particularly in relation to making investment decisions, so that capital can be best allocated to the places where adaptation is most needed. The need for investment is enormous, with the UN Environmental Programme estimating the adaption finance gap to be USD 194 billion to USD 366 billion, which is equivalent to 10 to 18 times current flows.

Measuring climate resilience: the Climate Bonds Resilience Taxonomy

This is why the Climate Bond Initiative has created the Climate Bonds Resilience Taxonomy (CBRT) – a framework to guide investment into climate resilience that measures an issuer’s ability to withstand and adapt to climate change impacts.

Access Here:

Key components of the Climate Bonds Resilience Taxonomy

The CBRT is designed to identify and categorise investments that strengthen climate resilience, thus helping investors to prioritise high-impact projects across the seven areas that the taxonomy covers. These include the physical, social, economic and natural aspects of resilience.

Both the users and use cases of the CBRT are diverse. It is a practical tool that can be used by governments, financial institutions, companies, and market observers. It will guide debt issuance, shape fiscal incentives, while at the same time informing corporate risk management and investment strategies.

In terms of methodology, it draws on the expertise of a wide range of stakeholders, integrating the latest scientific research and methodologies to address changing needs and enabling investments that foster resilience. Its three main criteria are:

- significant contributions made to resilience,

- the effective management of maladaptation risks,

- the alignment with broader sustainability goals.

The benefits of a standardised climate resilience taxonomy

The benefits of an effective taxonomy to measure resilience are widespread. The CBRT provides guidance to issuers so that they can identify and invest in resilience projects that have a significant impact. And by using a standardised methodology, these investments can be easily aligned with broader national and international climate goals, easing the flow of both public and private sector funding.

Unlocking new investment opportunities

The new taxonomy could unlock as much as USD 3 trillion in new investment for climate resilience by 2030, according to the CBI. Much of this funding would be directed towards Asia, given the region’s unique vulnerabilities to climate change in the face of rapid urbanisation.

Going forward, the CBRT will evolve as it is implemented in Asia. The CBI expects that it will adapt the taxonomy for local contexts, making sure that its criteria fit the local context, while at the same time maintaining compatibility with the global framework.

Furthermore, market engagement will help create a coalition for resilience investment, bringing together governments, financial institutions, investors, and issuers. A key part of this engagement will be clear guidance on how to apply the CBRT.

As climate change becomes a greater concern among the global investment community, the CBRT will likely become an important part of the financial toolkit used by financial professionals to make investment decisions related to sustainability.

Market outlook and future directions

BNP Paribas Markets 360 is forecasting USD 630 billion of green bond issuance in 2024, a record, with Asia Pacific expected to account for around USD 150 billion of this year’s total. This would be a slight step down from last year’s record, but still a large share of the overall market.

The bank sees a record wall of maturities coming over the next three years, so is forecasting rising issuance for green bonds in 2025 and 2026, with USD 700 billion and then USD 850 billion respectively. In particular, maturities from Chinese banks over the next two years will be elevated, so BNP Paribas’ Markets 360 team expects strong issuance from banks to replenish this maturing green credit.