Over the past year, the financial sector has faced numerous challenges across a volatile macro environment.

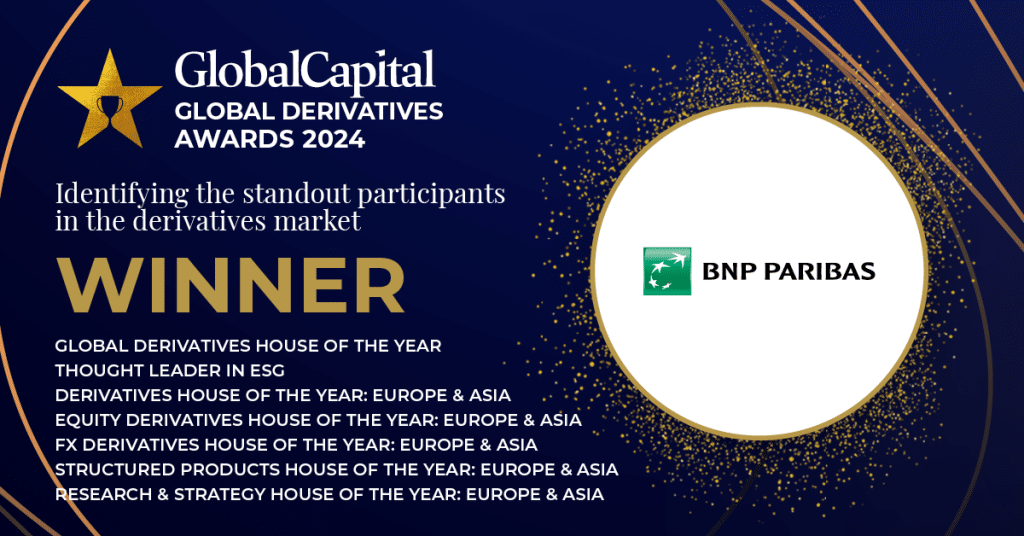

Against this backdrop, BNP Paribas has been named as Global Derivatives House of the Year, for the third year running at the Global Capital Derivatives Awards. The bank also received accolades in the following categories:

- Equity Derivatives House of the Year: Europe & Asia

- FX Derivatives House of the Year: Europe & Asia

- Structured Products House of the Year: Europe & Asia

- Thought Leader in ESG

- Research & Strategy House of the Year: Europe & Asia

Olivier Osty, Head of Global Markets at BNP Paribas, expressed his gratitude, saying, “I want to thank our clients for putting their trust in us during these challenging times. These awards reflect our commitment to delivering innovative solutions and exceptional service to our clients across asset classes, regions, and markets.”

These awards reflect our commitment to delivering innovative solutions and exceptional service to our clients across asset classes, regions, and markets.

Olivier Osty, Head of BNP Paribas CIB Global Markets.

The European bank on the world stage

By creating a robust and diversified derivatives business, BNP Paribas has emerged as a significant European banking partner supporting clients globally. Global Capital recognised BNP Paribas’ strides in the derivatives space, awarding the bank’s Equities, FX and Structured Products businesses, as well as naming BNP Paribas the overall Global Derivatives House of the Year.

Leader in sustainable finance

With its deep sustainability expertise and environmental, social, and governance (ESG) data solutions, BNP Paribas provides thorough analyses and future-casting of climate, biodiversity, and social trends to identify value opportunities for investors while seeking to minimise risks. For BNP Paribas, investing in adaptation is key to increase resilience and ensure long-term stability.

“As the bank for a changing world, we support our clients in channelling capital towards sustainable solutions that foster the resilience of both our economies and societies,” comments Constance Chalchat, Chief Sustainability Officer, BNP Paribas Global Markets & CIB. “Our commitment to sustainable finance is at the heart of our business strategy: we provide the insights, data, tools, and solutions to empower investors to profitably align their portfolios with their transition objectives.”

Navigating geopolitical risk

Markets 360TM – the economics and research division of BNP Paribas Global Markets – has provided clients with valuable insights and globally coordinated responses, including the implications across asset classes in the event of severe escalation. Recognising its dedication, Global Capital awarded BNP Paribas Research & Strategy House of the Year in Europe & Asia.

“In today’s increasingly complex and unpredictable geopolitical landscape, our commitment to delivering value to our clients is stronger than ever”, comments Luigi Speranza, Head of Markets 360TM at BNP Paribas. “By leveraging our strengths, including our innovative approach and our cutting-edge quantitative and sustainability expertise, we have been able to help our clients navigate the uncertain markets and have strengthened our position as a trusted and valued partner.”

What is Global Capital Derivatives Awards?

The Global Capital Derivatives Awards celebrate the leading banks, brokers, and service providers, as well as law firms, exchanges and other market participants for their contributions to the derivatives market across Europe, Asia, and the Americas. Find out more about the awards here.