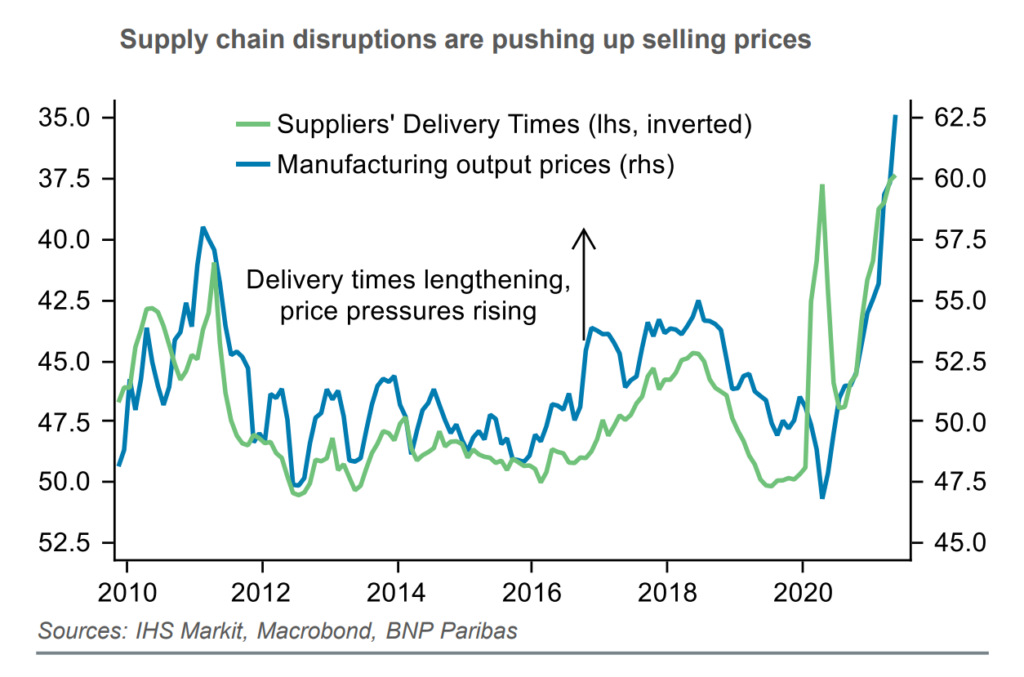

As the world gradually reopens and enters into post Covid-19 recovery, a combination of rising commodity prices, supply chain disruptions and mismatches between the speed at which demand and supply return is driving a price shock in the global economy. The question on everyone’s mind now is: will this trend last and is inflation here to stay?

The extent to which there should be concern over rising inflation depends on the following factors: whether the current rise in prices is transitory or signifies a more persistent trend; if the drivers of this rise are good or detrimental for equities; and how policymakers will respond.

Our long-held view is that although temporary in nature, the price shocks will last longer than central banks across advanced economies are currently assuming. This is fuelled by the interaction of a number of factors including a relatively quick absorption of economic slack, higher inflation expectations and a relatively relaxed attitude from central banks.

The US labour market is a case in point here. The conventional wisdom is that the unusual combination of high unemployment and relatively solid wage increases reflect transient frictions, due to mismatches between demand and supply of labour on the back of lingering Covid-related fears, issues with childcare and the (relatively generous) unemployment benefits, which might have discouraged some workers to accept new job offers. Although we do not disagree with this view, we would argue that other factors such as a higher propensity for early retirement, in response to the health scare, might also be playing a part. And therefore the participation rate could remain lower than pre-pandemic levels for much longer, contributing to tighter market conditions and potentially igniting wage growth sooner than expected.

While most of the recent price pressures are transitory in nature, reflecting for example supply chain bottlenecks, they have had already some impact on inflation expectations, which has the potential to transform them in a more enduring shock

Paul Hollingsworth, Chief European Economist, BNP Paribas

Solid growth accommodated by central banks and leading to more persistent and domestically generated inflation is fundamentally constructive for equity markets. However, a key risk to this scenario is getting too much of a good thing. If inflation runs out of control, markets might be concerned that central banks will have to make up by significantly increasing rates, and abruptly slow growth

Luigi Speranza, Chief Global Economist, BNP Paribas

In Europe, the situation is different than in the US, as furlough schemes have kept employers and employees attached, which has limited labour market frictions and kept wages dynamics in check so far. Still, with headline inflation expected to be at 3% in the Eurozone and around 4% in Germany by the end of 2021, collective negotiations next year should see higher wage demand.

A risk is that these global price pressures will be sustained and central banks are being called upon to act fast before inflation rises out of control. However, the response from central banks has been rather measured. The US Federal Reserve and the Bank of England have both indicated that they will wait to see inflation before acting rather than move in anticipation of it. The ECB’s newly-announced strategy review was a shift in a more dovish direction.

The central banks’ current approach does not mean that monetary policy will not be tightened but rather that the tightening will come later than expected and proceed in a more gradual fashion, than seen in the past under similar circumstances, a recipe for a tantrum-less taper.

While unlikely to result in a 1970-like inflation shock, we expect the current price shock to prove more persistent than generally assumed. This follows our call back in April 2020 that the medium-term impact of the Covid shock could prove to be inflationary. Our inflation forecasts are generally above the consensus and if anything we see risks to them as skewed to the upside

Olivia Frieser, Global Head of Markets 360

For more in depth analysis, please visit Markets 360 where you can sign up to receive thought-leading strategy and economics across all asset classes.

BNP Paribas does not consider this content to be “Research” as defined under the MiFID II unbundling rules. If you are subject to inducement and unbundling rules, you should consider making your own assessment as to the characterisation of this content. Legal notice for marketing documents, referencing to whom this communication is directed.