Financial services are the focus of regulators worldwide, therefore an effective regulatory strategy to anticipate and mitigate regulatory risks is the best protector of our clients’ interests and our business.

As the regulatory landscape continuously evolves, BNP Paribas Global Markets has the required expertise and agility to adapt to new regulatory challenges worldwide, as well as a forward looking approach thanks to our dedicated team of regulatory experts.

Regulatory updates

Key topics

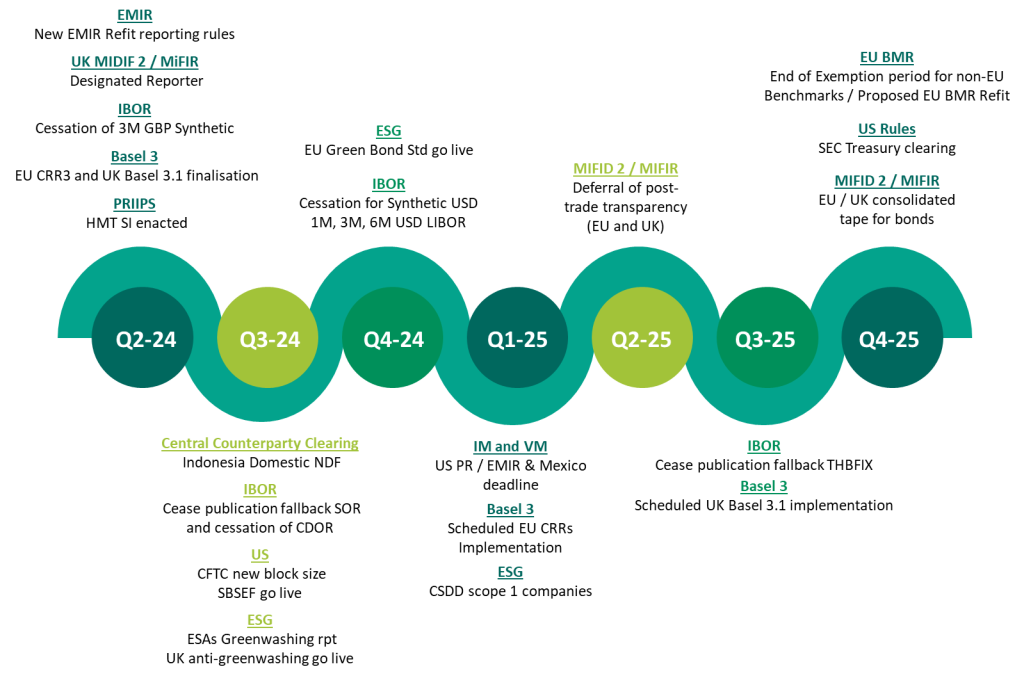

Global Markets Regulatory timeline

Markets structure

To prevent further financial crises, regulators worldwide have strengthened rules to minimise risky financial activities, reduce counterparty risk, protect investors and provide further transparency through a series of regulations (e.g. Dodd-Frank Act, EMIR, MIFID II, CSDR etc.). Educational materials on these regulations are accessible through our dedicated sales force.

IBOR transition

To respond to concerns about the reliability and robustness of the IBOR benchmark, regulators have globally signalled that firms should transition away from the London Interbank Offered Rate ‘LIBOR’ to alternative overnight risk-free rates (new RFRs). Contact our expert team for help with this transition including webinars and FAQs.

Prudential matters

To promote safety and soundness of financial firms, EU regulators have published a set of prudential requirements impacting firms’ liquidity and balance sheet (e.g. FRTB, Basel 3, Basel 4, ESG etc.).

Preparing for the future

With recent political changes, the expansion of digital technology alongside the transition to sustainable finance, the regulatory framework is rapidly evolving. Our teams are working hand-in-hand with clients to ensure we are ready for these new challenges.